The difference between a settlement entry and an adjustment entry in accounting

"Beware of little expenses. A small leak will sink a great ship." — Benjamin Franklin. This timeless reminder speaks directly to the heart of accounting that every entry, no matter how minor, carries weight. The accuracy of financial statements hinges on correctly identifying when to adjust and when to settle. By understanding the differences between settlement and adjusting entries, finance professionals can prevent errors that quietly erode financial truth. This article explains both concepts, offering clarity for better control and compliance.

What is an Adjusting Entry?

An adjusting entry is a journal entry made at the end of an accounting period to ensure that income and expenses are recorded in the correct period. These entries are essential for applying the accrual basis of accounting, which recognizes revenues and expenses when they are incurred, not when cash changes hands. Adjusting entries often deal with:

- Accruals: Expenses incurred but not yet paid (e.g., accrued salaries) or revenues earned but not yet received (e.g., interest income).

- Deferrals: Cash paid or received before the related expense or revenue is recognized (e.g., prepaid rent, unearned revenue).

- Allocations: Systematic charges like depreciation, amortization, or inventory adjustments.

The adjusting entries ensure that financial statements accurately reflect the business’s financial position and performance at the end of the period. They are typically recorded before preparing the trial balance for external reporting or audit.

What is a Settlement Entry?

A settlement entry is a journal entry used to close, offset, or reconcile outstanding balances once a transaction has been finalized. It reflects the actual payment or receipt of cash or goods and is often used to match previously recorded temporary or provisional entries. Unlike adjusting entries, which are made for timing and accrual reasons, settlement entries deal with real-world fulfillment of obligations, such as settling advances, clearing intercompany balances, or finalizing receivables and payables.

Examples of settlement entries include:

Examples of settlement entries include:

- Paying off an employee's advance after salary deduction.

- Recording the receipt of a payment that was previously accrued.

- Reconciling a vendor balance after a return or credit note.

- Closing a petty cash advance once receipts are submitted

Settlement entries help ensure that the books reflect cleared transactions, maintaining accuracy in cash flow, reconciliations, and account balances. These entries are critical for generating reliable financial data and keeping audit trails clean and consistent.

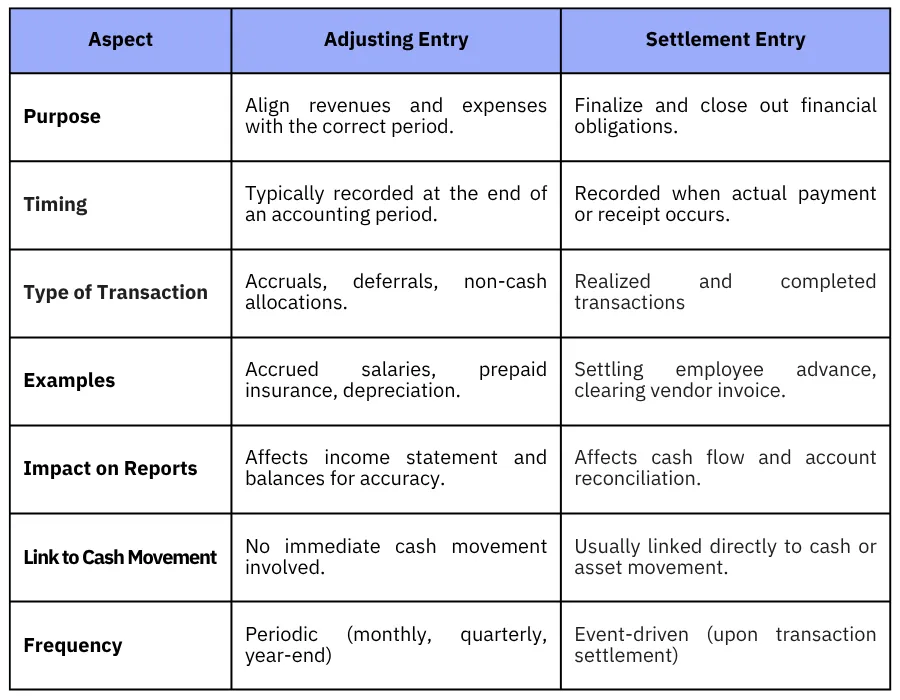

Key Differences Between Adjusting and Settlement Entries

Although adjusting and settlement entries are journal entries, they serve distinct purposes in the accounting process. Understanding the differences between both helps finance professionals ensure accuracy, compliance, and consistency in financial reporting. Here is a side-by-side comparison:

Common Mistakes When Recording These Entries

Even experienced accountants may occasionally confuse adjusting entries with settlement entries, leading to misstatements in financial records. Below are some of the most frequent mistakes and how to avoid them:

- Misclassifying the Entry Type Recording a cash payment as an adjusting entry instead of a settlement entry is a common error. Adjusting entries are usually non-cash, while settlement entries reflect actual payment or receipt. Ask whether cash has moved. If yes, it’s likely a settlement entry.

- Delayed Adjustments Failing to record adjusting entries before period-end results in inaccurate financial reports. This leads to misstated profits, understated liabilities, or overstated assets. Always schedule adjusting entries in your month-end or year-end closing checklist.

- Overuse of Adjusting Entries Some businesses rely too much on adjusting entries to correct operational inefficiencies. This leads to unnecessary complexity and a lack of real-time visibility. So use adjusting entries to reflect timing, not compensate for poor documentation or delayed transactions.

- Forgetting to Reverse Adjusting Entries Accrual-related adjusting entries (like accrued expenses) often need to be reversed in the following period. Failing to do so may result in double-counting. Use automation or reminders to schedule reversing entries during the next cycle.

When to Use Each Entry in Practice

Choosing between an adjusting entry and a settlement entry depends on timing, transaction status, and purpose. Misusing either can lead to financial discrepancies, audit issues, and poor decision-making.

Use Adjusting Entries When:

- You’re preparing financial statements and need to reflect revenues and expenses in the correct period.

- An expense has been incurred, but not yet paid (e.g., utilities used in December, billed in January).

- Revenue has been earned, but not yet received (e.g., a service delivered in March, payment expected in April).

- You’re allocating costs over time (e.g., depreciation or prepaid insurance).

- You’re applying the accrual accounting principle.

Scenario Example:

Scenario Example:

At year-end, you estimate unpaid employee bonuses and record them as an accrued expense via an adjusting entry.

Use Settlement Entries When:

- Cash or other assets have moved, and you’re finalizing a previously recorded obligation.

- An employee has submitted receipts to clear a petty cash advance.

- A customer makes a payment toward an invoice issued earlier.

- You’re closing out supplier balances or issuing credit notes.

Scenario Example:

Scenario Example:

You’ve previously accrued supplier costs for delivered goods, and now the payment is made. You record a settlement entry to clear the payable.

Also Read: What is a reversing entry in accounting? And when is it used?

How Wafeq Automates Adjusting and Settlement Entries

Manual entries can slow down month-end close and introduce risk. Wafeq's smart accounting automation simplifies the recording process of both adjusting and settlement entries, ensuring compliance, accuracy, and speed.

Automating Adjusting Entries:

Wafeq helps to reduce reliance on spreadsheets and ensures that end-of-period adjustments are timely, consistent, and documented. This is through the following features:

- Create recurring adjusting entries (e.g., monthly depreciation, accruals).

- Schedule entries to auto-post on specific dates.

- Set up reversing entries to be posted in the following period.

- Tag entries by department or cost center for reporting precision.

Automating Adjusting Entries:

Wafeq integrates with banking and payment systems to streamline real-time settlements, which enables the finance team to close the loop on transactions faster, ensuring your records always reflect real activity.

- Match payments automatically to outstanding invoices or advances.

- Record settlements instantly when bank transactions are synced.

- Enable approval workflows before finalizing payments.

- Clear employee advances upon receipt of uploads.

Also Read: Accrual Accounting Essentials: Prepaid Expenses, Accruals, and Revenue Deferrals Explained.

Understanding the difference between a settlement entry and an adjusting entry is fundamental to maintaining accurate, compliant, and meaningful financial records. While adjusting entries ensure that financial reports reflect the true economic activity of a period, settlement entries document the real movement of funds and the fulfillment of obligations. For finance professionals, mastering the use of both entries enhances the clarity, credibility, and control of financial reporting. And with modern accounting tools like Wafeq, the process becomes more efficient and less error-prone, transforming once-manual tasks into automated, reliable workflows. Whether for closing monthly books or preparing for an audit, the right use of these entries ensures your financials tell the right story.

FAQs about Adjusting and Settlement Entries

What is the difference between settlement entries and closing entries?

Settlement entries record the true movement of funds, such as paying an invoice or settling a petty cash advance. These are operational entries reflecting real transactions. Closing entries, on the other hand, are used at the end of the accounting period to close temporary accounts (like revenues and expenses) into retained earnings, and their purpose is to reset balances for the next period.

What is the difference between journal entries and settlement entries?

A journal entry is a broad term that refers to any entry recorded in the accounting journal, which includes adjusting, settlement, closing, or any other type. Settlement entries are a specific type of journal entry that reflect the completion or clearing of a previous obligation, typically involving a cash or asset movement.

What are inventory settlement entries?

Inventory settlement entries adjust inventory-related accounts to reflect actual stock levels or costs. These are often adjusting entries recorded at the end of a period to match physical inventory with accounting records. They may include:

- Writing off damaged or expired stock.

- Adjusting inventory values based on physical counts.

- Recording inventory shrinkage or overages.

What are accounts under settlement?

Accounts under settlement refer to accounts that are awaiting documentation, clearance, or payment. These accounts are not yet finalized and require further action to be settled and closed. Examples include:

- Advances given to employees pending receipts.

- Supplier invoices received but not yet paid.

- Pending adjustments for bank reconciliations.

Join hundreds of finance teams using Wafeq to automate accounting workflows, close books faster, and maintain error-free records.

Join hundreds of finance teams using Wafeq to automate accounting workflows, close books faster, and maintain error-free records.

.png?alt=media)