Understanding the Difference Between the Balance Sheet and Cash Flow Statement

Why do the balance sheet and the cash flow statement, although both essential financial reports, present different views of a company's financial position? The balance sheet and the cash flow statement are two of the most critical financial statements businesses and stakeholders use. Each provides valuable insights, yet they serve distinct purposes. While the balance sheet presents the company’s financial standing at a specific point in time, the cash flow statement outlines the movement of cash over a period, highlighting liquidity and operational efficiency.

This article explores the key differences between the two statements, how they complement one another, and their role in accurate financial analysis and decision-making.

Understanding the Balance Sheet and Its Components

The balance sheet, also known as the statement of financial position, provides a snapshot of a company’s financial status at a specific point in time. It outlines what the company owns (assets), what it owes (liabilities), and the residual interest belonging to shareholders (equity). This statement is divided into three major components:

- Assets: What a company owns (such as cash, inventory, and real estate).

- Liabilities: Reveals what a company owes (such as loans and accounts payable).

- Equity: The owner's or shareholders' stake in the company after subtracting liabilities from assets.

Balance Sheet Equation:

Balance Sheet Equation:

Assets = Liabilities + Equity

This equation must always be balanced, which is why it's called the balance sheet. It reflects the idea that everything a company owns (assets) is financed either by borrowing (liabilities) or by owner investments (equity).

Balance Sheet Items (in detail)

1. Assets Assets are a company's resources available to generate revenue now and in the future and are classified as either current assets or non-current assets:

- Current assets: Assets that are expected to be converted into cash or consumed within one year.

Examples of current assets:

Examples of current assets:

- Cash and cash equivalents.

- Accounts receivable (money owed by customers).

- Inventory (goods ready for sale).

- Prepaid expenses (such as prepaid insurance).

- Non-current assets are long-term assets that provide value over more than one year.

Examples of non-current assets:

Examples of non-current assets:

- Property, plant, and equipment (PP&E), such as buildings and machinery.

- Intangible assets (such as patents, trademarks, and goodwill).

- Long-term investments.

2. Liabilities Liabilities represent what the company owes to others. Like assets, they are divided into current and non-current liabilities:

- Current liabilities: Obligations due within one year.

Examples of current liabilities:

Examples of current liabilities:

- Accounts payable (money owed to suppliers)

- Short-term debts (loans due within a year)

- Accrued expenses (such as wages payable and taxes payable)

- Non-current liabilities: These are long-term obligations due after one year.

Examples of non-current liabilities:

Examples of non-current liabilities:

- Long-term debt (such as bank loans and bonds)

- Deferred tax liabilities

- Pension liabilities.

3. Equity Equity, also known as shareholders' equity or owners' equity, represents the remaining interest in a company after subtracting its liabilities from its assets. It includes the following:

- Common stock: The value of shares issued to shareholders.

- Retained earnings: Earnings reinvested in the business rather than distributed as dividends.

- Additional paid-in capital: also known as Share Premium, refers to the amount investors pay for a company’s shares above their par value (nominal value) during issuance.

Know more about: How to prepare a balance sheet.

What is a cash flow statement?

While the balance sheet provides an overview, the cash flow statement is more like a movie, tracking the cash movement in and out of a company over a specific time. The statement is divided into three sections:

- Operating activities: Cash generated from day-to-day business operations.

- Investing activities: Cash used in or generated from investments (such as purchasing equipment or selling assets).

- Financing activities: Cash generated from borrowing, repaying loans, or issuing stock.

The cash flow statement helps answer the question: Does the company generate enough cash to sustain its operations and growth?

The cash flow statement helps answer the question: Does the company generate enough cash to sustain its operations and growth?

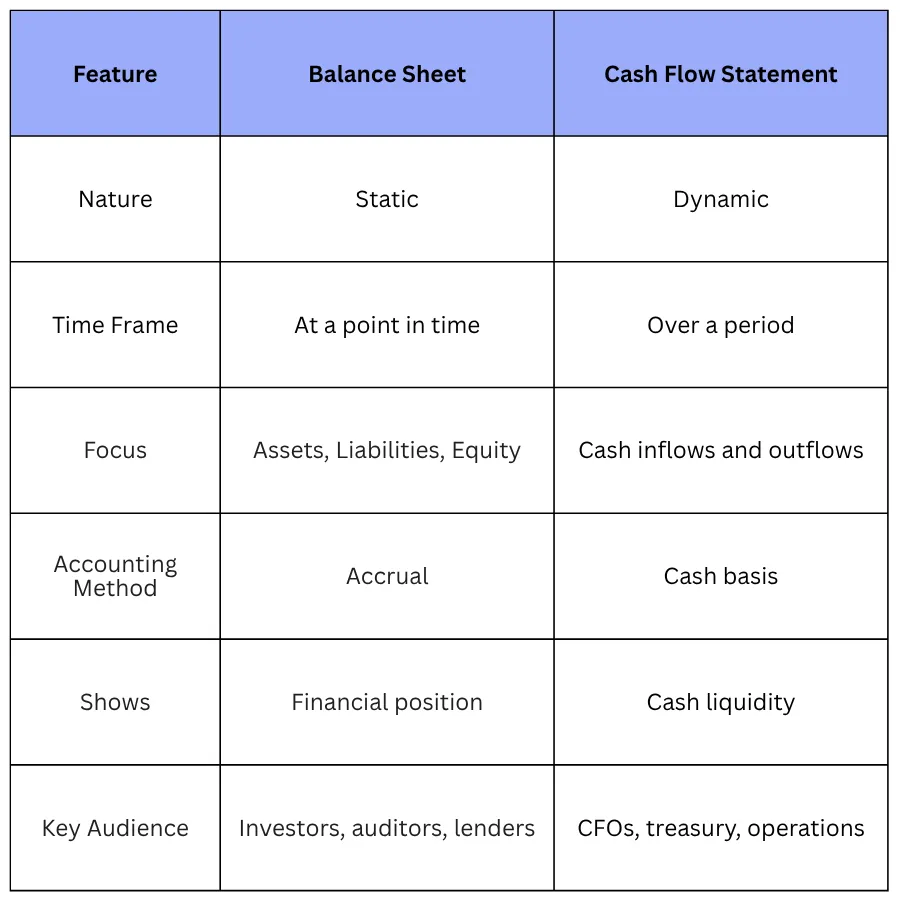

The Key Differences Between the Balance Sheet and the Cash Flow Statement

Integration between the balance sheet and cash flow statements

The balance sheet And cash flow statements are two sides of the same coin. For example, if a company's balance sheet shows significant debt, the cash flow statement reveals whether the company is generating enough cash to pay off that debt. Similarly, a healthy cash flow statement may show strong operating cash flows, but if the balance sheet shows a decline in assets, this could indicate underlying problems.

Although the balance sheet and cash flow statement serve different purposes, they are interconnected and interdependent. A single change in one will almost always impact the other, especially when analyzing financial health and performance across periods. The cash flow statement is often derived using changes in the balance sheet between two periods. Specifically, the indirect method of preparing cash flows from operating activities relies on adjusting net income with changes in working capital, which are extracted from two comparative balance sheets.

How They Connect

Integration between the two statements ensures internal consistency between the various financial statements, allows for accurate tracking of cash sources and uses, and improves the accuracy of financial forecasting by linking operational performance to cash flow. The most important of these integrations are:

1. Changes in Assets and Liabilities

- A decrease in accounts receivable (an asset) results in a positive cash flow because more cash is collected.

- An increase in accounts payable (a liability) results in positive cash flow, as payments are delayed.

2. Impact of Investing and Financing Activities

- A purchase of fixed assets reduces cash and increases non-current assets.

- Issuing new equity increases cash and also shareholders’ equity.

3. Reconciliation The ending cash balance on the cash flow statement must match the cash account in the balance sheet at the end of the period.

Illustrative Example

Illustrative Example

If a company’s inventory increases by SAR 50,000, it appears as an increase in current assets on the balance sheet and as a deduction from operating cash flow on the cash flow statement. This shows that cash has been used to purchase inventory.

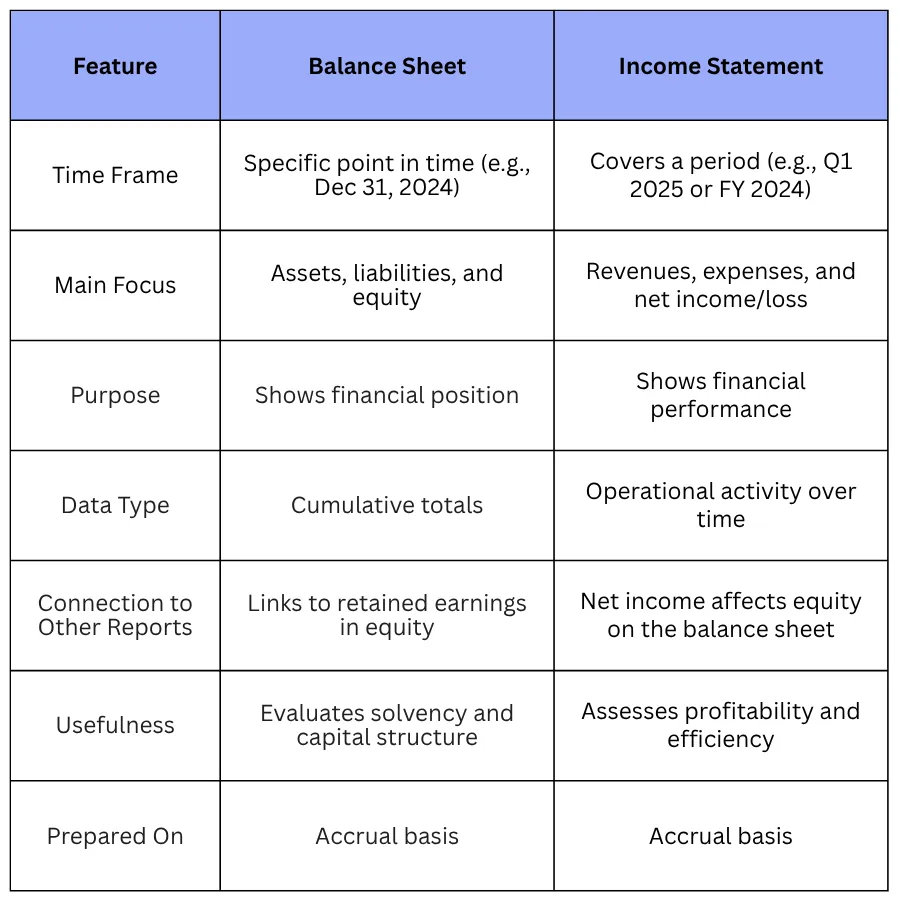

What is the Difference Between the Balance Sheet and the Income Statement?

The balance sheet and the income statement are two of the three primary financial statements. While they complement each other, they serve different objectives and present various aspects of a company’s financial performance and position. Analysts use the income statement to assess profitability, while the balance sheet helps determine financial health and stability. Reviewing both together provides a more complete financial picture.

Know more about: The Balance Sheet and Income Statement.

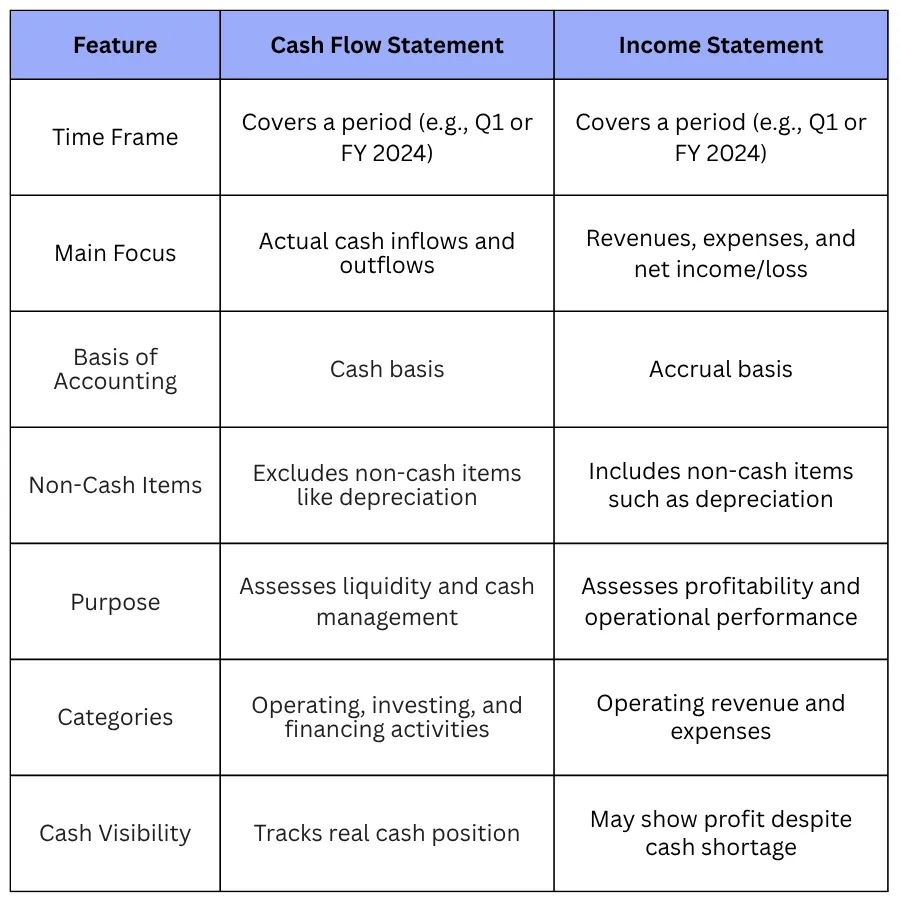

Cash Flow Statement Vs the Income Statement

Also Read: A comprehensive explanation of the income statement, its sections, and its importance to businesses

What Is the Difference Between the Balance Sheet, the Budget, and the Appropriation?

- Balance Sheet A financial statement that presents a company’s assets, liabilities, and equity at a specific point in time. It reflects the company's actual financial position and is based on historical data.

- Budget A financial plan estimating revenues, expenses, and cash flows for a future period, usually prepared annually. It serves as a guideline or target for managing resources and controlling costs.

- Appropriation (sometimes called “Mawazna” in governmental terms) The legal authorization or allocation of budgeted funds to specific departments or projects, often within government entities. It defines how the budget will be spent.

Also Read: Understanding Balance Sheets: A Simplified Guide for Non-Accountants.

The balance sheet and the cash flow statement are two fundamental financial reports that both provide a comprehensive picture of a company’s financial health. While the balance sheet offers a static snapshot of assets, liabilities, and equity at a specific date, the cash flow statement reveals the dynamic cash movement within the business over time.

Understanding the differences and connections between these statements is essential for accurate financial analysis, better decision-making, and effective resource management. Integrating insights from both reports allows stakeholders to evaluate the company’s financial position, in addition to its liquidity and operational efficiency.

FQAs about Financial Statements

Is the balance sheet the same as the statement of financial position?

Yes. The terms “balance sheet” and “statement of financial position” refer to the same financial report. The term “statement of financial position” is considered more modern and descriptive, emphasizing that the report presents a company’s financial condition at a specific point in time. Both names are used interchangeably in accounting and financial reporting.

Can a company be profitable yet face cash flow problems?

Yes. Profit does not always translate into cash; non-cash revenues or delayed collections can create cash shortages.

Which financial statement better indicates liquidity?

The cash flow statement tracks real cash inflows and outflows.

How is depreciation reflected differently in the balance sheet and cash flow statement?

Depreciation reduces asset value on the balance sheet but is added back in cash flow since it is a non-cash expense.

Simplify your financial management with Wafeq. Experience accurate, automated reporting today.

Simplify your financial management with Wafeq. Experience accurate, automated reporting today.

.png?alt=media)