VAT vs Corporate Tax in UAE: Registration, Calculation & Compliance

A business owner reviews the monthly financial reports and notices two different tax figures: one tied to every invoice issued, and another calculated at year-end based on profits. Both are mandatory, both affect cash flow, yet each follows a completely different logic and purpose. This moment of confusion is common among companies operating in the UAE’s evolving tax environment.

Understanding the difference between VAT and corporate tax in the UAE is essential for accurate compliance, effective tax planning, and informed financial decision-making.

What Is the Difference Between VAT and Corporate Tax in the UAE?

One of the most common tax-related questions among businesses in the UAE is whether VAT and corporate tax are the same, and the short answer is no.

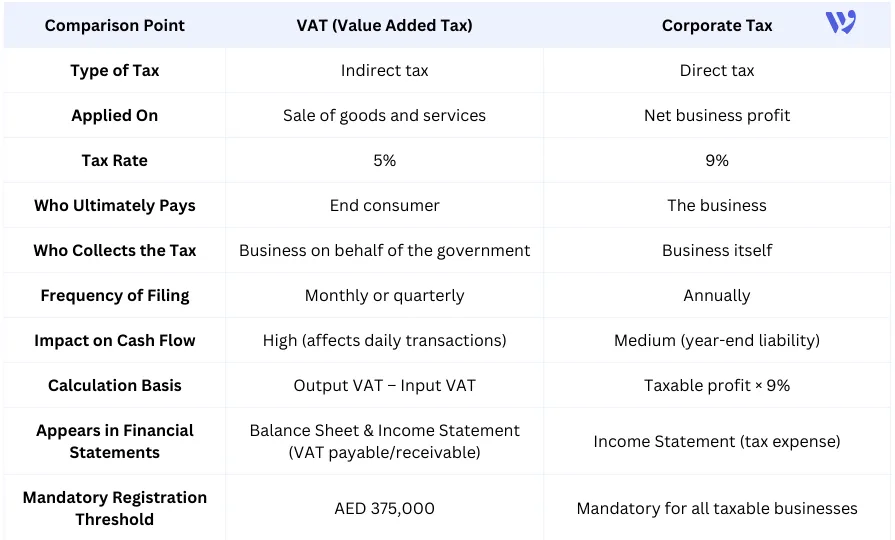

Although both are government-imposed taxes, VAT and corporate tax differ fundamentally in purpose, calculation, and impact on businesses. VAT is linked to transactions and consumption, while corporate tax is linked to profitability. Understanding this distinction is essential for compliance, cash flow management, and accurate financial reporting.

- VAT applies to sales and purchases.

- Corporate tax applies to net profits.

- Businesses collect VAT on behalf of the government, but pay corporate tax directly.

What Is VAT in the UAE?

Value Added Tax (VAT) in the UAE is an indirect tax imposed on the consumption of goods and services at each stage of the supply chain. Introduced in 2018, VAT is charged at a standard rate of 5% and is ultimately borne by the end consumer.

Businesses registered for VAT are responsible for:

- Charging VAT on taxable sales (Output VAT)

- Paying VAT on eligible purchases (Input VAT)

- Reporting the difference to the Federal Tax Authority (FTA)

VAT does not represent a cost to the business in most cases. Instead, companies act as tax collectors on behalf of the government, which is why accurate invoicing and record-keeping are critical.

VAT does not represent a cost to the business in most cases. Instead, companies act as tax collectors on behalf of the government, which is why accurate invoicing and record-keeping are critical.

When Should You Register for VAT in the UAE?

VAT registration in the UAE depends on your annual taxable turnover:

- Mandatory registration: If taxable supplies exceed AED 375,000 in the past 12 months or are expected to exceed it in the next 30 days.

- Voluntary registration: If taxable supplies exceed AED 187,500.

Registering at the right time helps businesses avoid penalties and ensures they are able to reclaim input VAT.

Registering at the right time helps businesses avoid penalties and ensures they are able to reclaim input VAT.

What Are Corporate Taxes in the UAE?

Corporate tax in the UAE is a direct tax imposed on the net profits of businesses. It came into effect for financial years starting on or after 1 June 2023, marking a major shift in the UAE’s tax framework.

Key features of UAE corporate tax include:

- A 0% rate on taxable profits up to AED 375,000.

- A 9% rate on taxable profits exceeding AED 375,000.

- Applied to companies and individuals conducting business activities.

- Calculated and paid on an annual basis.

Also Read about: The New Corporate Tax System in the UAE and How Wafeq Automates Accounting

When Should You Register for Corporate Tax in the UAE?

- Registration is mandatory, even if no tax is payable.

- Registration deadlines vary based on license issuance date.

- Failure to register on time may result in penalties.

- Registration is mandatory, even if no tax is payable.

- Registration deadlines vary based on license issuance date.

- Failure to register on time may result in penalties.

How Is Tax Calculated in the UAE?

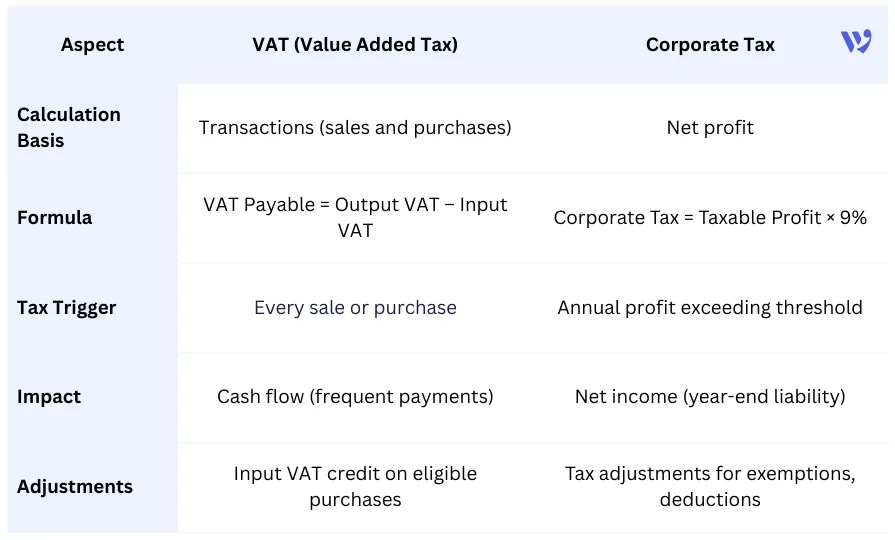

Understanding how VAT and corporate tax are calculated is essential for accurate compliance and effective tax planning. Although both are taxes, the calculation logic is completely different.

How Is VAT Calculated in the UAE?

VAT in the UAE is calculated using a credit method, where businesses offset the VAT they collect against the VAT they pay.

VAT Formula:

VAT Formula:

VAT Payable = Output VAT – Input VAT

- Output VAT: VAT charged on sales

- Input VAT: VAT paid on eligible purchases

* If the output VAT is higher, the business pays the difference to the FTA.

* If input VAT is higher, the business may carry forward or reclaim the balance.

Read Also: VAT Calculator UAE – Accurate & Instant VAT Calculation Online.

How Is Corporate Tax Calculated in the UAE?

Corporate tax is calculated based on taxable profit, not total revenue.

Corporate Tax Formula:

Corporate Tax Formula:

Corporate Tax = Taxable Profit × 9%

Taxable profit is derived from:

- Accounting profit.

- Adjusted for allowable deductions and exemptions.

- Excluding profits under the AED 375,000 threshold.

Key Difference in Calculation

How Are VAT and Corporate Tax Reported in Financial Statements?

Accurate reporting of VAT and corporate tax in financial statements is critical for compliance and transparency. Both taxes affect financial records differently:

VAT in Financial Statements:

- Appears as VAT Payable (liability) if collected from customers.

- Appears as VAT Receivable (asset) if input VAT exceeds output VAT.

- Reflected in the balance sheet under current liabilities or current assets.

- Only affects cash flow, not profit.

Corporate Tax in Financial Statements:

- Appears as Tax Expense in the income statement.

- Reduces net profit for the period.

- Recorded as a liability until paid.

- Impacts both the income statement and balance sheet (liability section).

Common Mistakes Businesses Make Regarding VAT and Corporate Tax

Many businesses in the UAE face penalties not because of intentional non-compliance, but due to common errors in VAT and corporate tax management. Recognizing these mistakes can help prevent fines and improve financial efficiency.

Common VAT Mistakes:

- Late Registration: Failing to register on time, even when the taxable turnover exceeds the threshold.

- Incorrect VAT Rate: Charging the wrong rate or applying exemptions incorrectly.

- Poor Record-Keeping: Losing invoices, receipts, or support documents required by the FTA.

- Late Filing: Missing deadlines for VAT return submissions.

- Incorrect Input/Output VAT Calculation: Miscalculating VAT payable or refundable amounts.

know more about: VAT Return: Definition, Importance, and Free Downloadable Template.

Common Corporate Tax Mistakes:

- Failure to Register: Not registering with the FTA despite being subject to corporate tax.

- Incorrect Profit Reporting: Misreporting taxable profits due to accounting errors or missing adjustments.

- Late Filing or Payment: Missing deadlines for corporate tax return submission or payment.

- Ignoring Allowable Deductions: Failing to apply legal deductions, exemptions, or reliefs.

- Mixing VAT and Corporate Tax Records: Confusing transaction-level VAT with profit-level corporate tax, leading to misreporting.

Practical Examples and Calculations – VAT vs Corporate Tax

Understanding VAT and corporate tax is easier with real-world examples. Let’s look at how both taxes are calculated in practice.

Example 1: VAT Calculation

Example 1: VAT Calculation

A business makes AED 500,000 in sales during a quarter and pays AED 100,000 in VAT on purchases.

- Output VAT: 500,000 × 5% = AED 25,000

- Input VAT: AED 100,000 × 5% = AED 5,000 (eligible for credit)

- VAT Payable = Output VAT – Input VAT = 25,000 – 5,000 = AED 20,000

The business will pay AED 20,000 to the FTA.

Example 2: Corporate Tax Calculation

Example 2: Corporate Tax Calculation

A company earns AED 1,000,000 profit in the financial year.

- Tax-free threshold = AED 375,000

- Taxable profit = 1,000,000 – 375,000 = AED 625,000

- Corporate Tax = 625,000 × 9% = AED 56,250

The company will pay AED 56,250 in corporate tax.

Tips for Optimizing Tax Efficiency in UAE Businesses

Optimizing tax efficiency in the UAE is essential to reduce costs, maintain compliance, and improve cash flow. Here are some practical tips:

- Separate VAT and Corporate Tax Records: Keep transaction-level VAT separate from profit-level corporate tax to avoid errors.

- Use Accounting Software: Systems like Wafeq automate calculations, generate accurate reports, and send reminders for deadlines.

- Monitor Thresholds: Track sales and profits to ensure timely VAT registration and corporate tax compliance.

- Leverage Allowable Deductions: Identify all deductions and exemptions to reduce taxable profits legally.

- Regular Reconciliation: Reconcile VAT input/output and profit records frequently to prevent discrepancies.

- Seek Professional Advice: Engage tax consultants for complex transactions or international dealings.

How Wafeq Can Help Automate VAT and Corporate Tax Management?

Managing VAT and corporate tax in the UAE can be complex and time-consuming, especially for growing businesses. Wafeq Accounting System simplifies this process and ensures full compliance with the Federal Tax Authority (FTA).

Key Benefits of Wafeq:

- Automated Tax Calculations: Calculates VAT on transactions and corporate tax on profits automatically.

- Real-Time Reporting: Generate VAT returns and corporate tax reports instantly, reducing errors and manual work.

- Integrated Record-Keeping: Stores invoices, receipts, and financial statements securely for easy audit compliance.

- Deadline Alerts: Reminders for VAT filing and corporate tax submission to avoid penalties.

- Multi-Entity Support: Manage taxes for multiple companies or branches in one centralized system.

Read Also about: Common mistakes businesses make in corporate tax filing.

Understanding the differences between VAT and corporate tax is crucial for UAE businesses to maintain compliance, avoid penalties, and optimize financial efficiency. VAT focuses on transactions, while corporate tax targets net profits, and both require proper record-keeping and timely filings. By adopting structured processes and leveraging tools like Wafeq, businesses can simplify tax management, reduce errors, and focus on growth.

FAQs About VAT vs Corporate Tax in the UAE

What is the main difference between VAT and corporate tax?

VAT is a transaction-based tax applied to goods and services, while corporate tax is a profit-based tax applied to net business profits.

Do all businesses in the UAE pay VAT and corporate tax?

- VAT: Businesses exceeding the mandatory threshold (AED 375,000) must register.

- Corporate Tax: All businesses subject to corporate tax must register, regardless of profit.

How often should VAT and corporate tax be filed?

- VAT: Monthly or quarterly, depending on turnover.

- Corporate Tax: Annually, based on the financial year.

Can input VAT be reclaimed?

Yes, businesses can reclaim input VAT paid on purchases, reducing the total VAT payable.

What happens if a business misses VAT or corporate tax deadlines?

Penalties and fines may apply, and interest may accrue. Timely registration and submission are crucial.

How is VAT different from corporate tax in accounting records?

- VAT: Recorded in the balance sheet as VAT payable/receivable; does not affect net profit.

- Corporate Tax: Recorded as tax expense in the income statement; reduces net profit.

With Wafeq Accounting Software, Automate calculations, generate accurate reports, and stay fully compliant with UAE tax laws.

With Wafeq Accounting Software, Automate calculations, generate accurate reports, and stay fully compliant with UAE tax laws.

(1).png?alt=media)

.png?alt=media)

.png?alt=media)

.png?alt=media)

.png?alt=media)