Overtime Calculator: How to Calculate Overtime Pay Accurately

It’s the end of the month, and a payslip arrives showing more hours worked than usual—but the final number doesn’t immediately make sense. Extra evenings, extended shifts, and weekend work should mean higher pay, yet calculating the true value of those additional hours often feels unclear and time-consuming.

Most users search for an overtime calculator because they want quick answers to practical questions: Am I being paid correctly? How much should my overtime be worth? This tool removes uncertainty and provides clarity, especially in workplaces where overtime rates vary by policy, labor law, or contract. Whether you are an employee reviewing your payslip or an employer ensuring payroll accuracy, an overtime calculator offers transparency, accuracy, and time savings.

What Is an Overtime Calculator?

An overtime calculator is a simple yet powerful tool that helps employees and employers calculate extra pay earned for hours worked beyond regular working hours. Instead of manually applying formulas or guessing overtime rates, the calculator instantly shows how much overtime pay is due based on hourly wage, total hours worked, and applicable overtime rules.

How to Calculate Overtime Pay

Overtime pay is calculated by multiplying the regular hourly wage by the overtime rate for each hour worked beyond standard working hours. The first step is identifying regular working hours, then counting any additional hours as overtime.

for work beyond standard working hours. The first step is to identifying regular working hours, then count any additional hours as overtime.

Overtime calculation formula:

Overtime calculation formula:

Hourly rate × Overtime rate × Number of overtime hours.

Simple example:

Simple example:

If the hourly rate is 20, the overtime rate is 1.5×, and overtime hours equal 4:

20 × 1.5 × 4 = 120 in overtime pay.

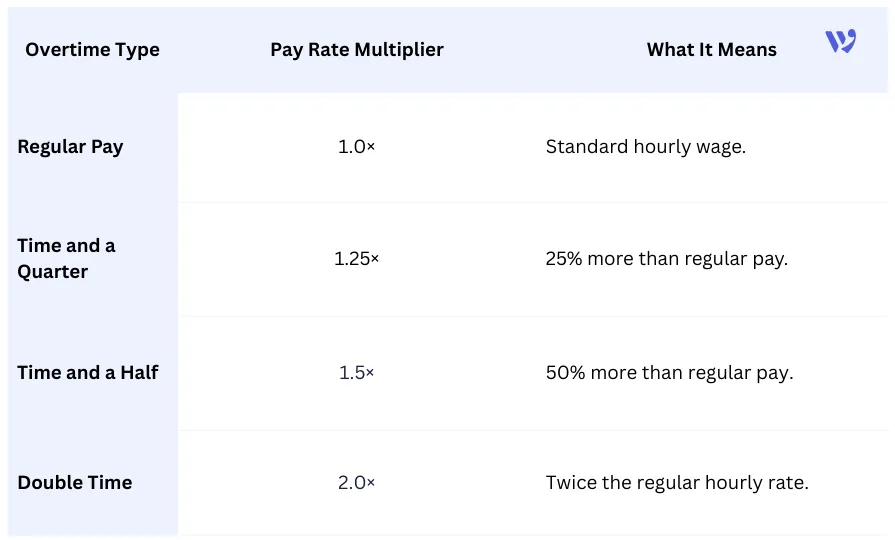

Overtime Pay Rates Explained

The overtime rate refers to the increased pay applied to hours worked beyond regular working hours. Instead of the standard hourly wage, overtime hours are compensated using a higher multiplier, most commonly ×1.25, ×1.5, or ×2. The exact overtime rate depends on labor laws, company policy, and the timing of the extra work, such as weekends, public holidays, or night shifts. This is why using an overtime calculator is essential as it ensures the correct rate is applied automatically, helping employees confirm fair pay and employers maintain accurate, compliant payroll calculations.

One of the most common reasons people search for an overtime calculator is confusion around overtime pay rates. Overtime is rarely paid at same rate as regular hours. Instead, labour laws and company policies usually require a higher multiplier to compensate employees for extra time worked. The most widely used overtime rates include:

- Time-and-a-quarter.

- Time-and-a-half.

- Double time.

An overtime calculator automatically applies these multipliers, ensuring the correct rate is used without manual effort or miscalculation. Understanding these rates is essential, not only to verify payslips but also to avoid underpayment or payroll disputes. Below is a simple comparison to clarify how overtime rates typically work.

An overtime calculator uses this logic instantly, making it especially useful when different rates apply on weekends, holidays, or night shifts.

An overtime calculator uses this logic instantly, making it especially useful when different rates apply on weekends, holidays, or night shifts.

Example 1: Overtime on a Regular Workday

Example 1: Overtime on a Regular Workday

Hourly rate: 25

Regular hours: 8

Total hours worked: 10

Overtime hours: 2

Overtime rate: ×1.5

Calculation:

25 × 1.5 × 2 = 75 overtime pay

Example 2: Overtime on a Weekend

Example 2: Overtime on a Weekend

Hourly rate: 30

Hours worked: 6

Overtime rate: 2×

Calculation:

30 × 2 × 6 = 360 overtime pay

Example 3: Mixed Overtime Rates in One Week

Example 3: Mixed Overtime Rates in One Week

Hourly rate: 20

3 hours at 1.5×

2 hours at 2×

Calculation:

(20 × 1.5 × 3) + (20 × 2 × 2)

= 90 + 80

= 170 total overtime pay

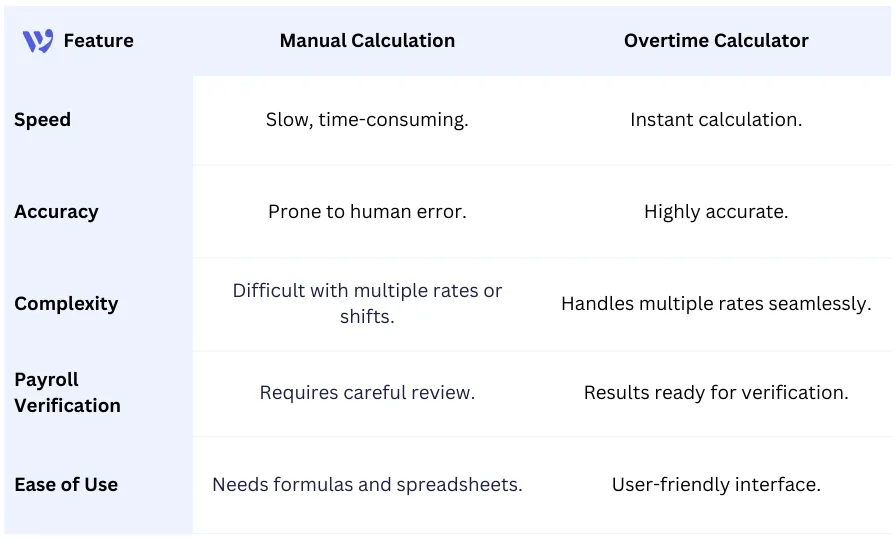

Overtime Calculator vs Manual Calculation: Which Is More Accurate?

Many employees and employers still try to calculate overtime manually using formulas or spreadsheets—but this approach is often prone to mistakes. Even a small error in the hourly rate, overtime multiplier, or total hours can lead to incorrect pay.

An overtime calculator eliminates this risk by automating the process. It ensures every extra hour is accounted for accurately, saving time and avoiding disputes. Below is a comparison to show why using a calculator is more reliable than manual methods:

Common Overtime Calculation Mistakes and How to Avoid Them

Even experienced payroll staff can make mistakes when calculating overtime manually. Here are some common errors and how an overtime calculator can help prevent them:

- Misapplying Overtime Rates: Confusing time-and-a-half with double time or forgetting weekend/holiday rates. A calculator automatically applies the correct multiplier.

- Incorrect Hour Totals: Forgetting to subtract breaks or miscounting hours can lead to underpayment or overpayment. Calculators track all inputs precisely.

- Ignoring Labour Law Variations: Different regions have different rules for overtime eligibility. Many calculators are updated to reflect local labour regulations.

- Forgetting Shift Differentials: Night shifts or premium hours are sometimes overlooked. Advanced calculators include these factors.

When Should You Use an Overtime Calculator?

Many users don’t search for an overtime calculator out of curiosity—they search because they are unsure whether their extra hours are being calculated correctly. An overtime calculator becomes especially useful when working variable shifts, weekend hours, or when overtime rates change based on company policy or labour law.

You should use an overtime calculator whenever your working hours go beyond the standard schedule, when reviewing your payslip, or when managing payroll for multiple employees. In these cases, the calculator helps confirm accuracy, avoid disputes, and ensure fair compensation without relying on assumptions or manual math.

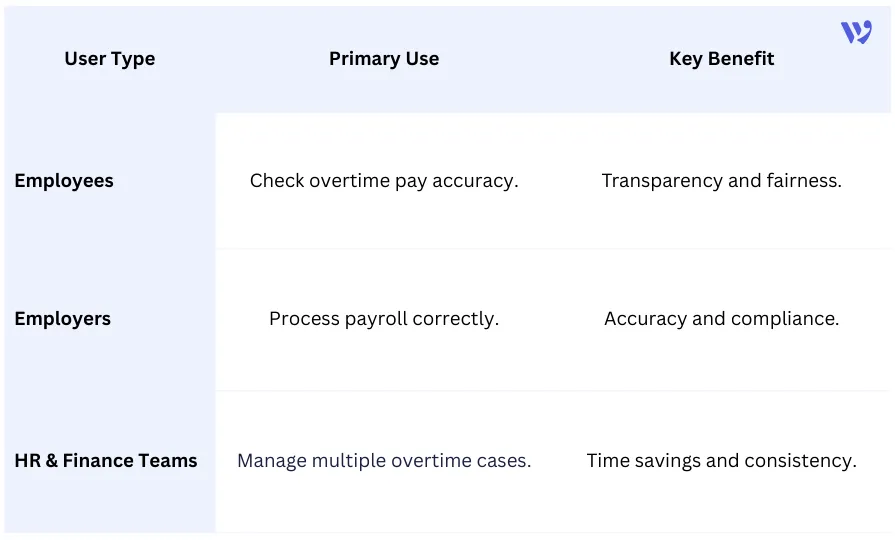

Overtime Calculator for Employees vs Employers

While employees and employers may use the same overtime calculator, their goals are often very different. Understanding these differences helps explain why this tool is so widely searched and used across organizations.

For employees, the overtime calculator is mainly about verification and transparency. Employees want to confirm that their extra hours are calculated correctly, that the right overtime rate is applied, and that their payslip reflects the actual time worked. It provides peace of mind and confidence when reviewing monthly pay.

For employers and HR teams, the overtime calculator is a payroll control tool. It helps ensure consistency, reduce calculation errors, and maintain compliance with labor laws. When managing multiple employees, shifts, or overtime rates, the calculator becomes essential for efficiency and fairness.

Overtime Calculator and Labor Law Considerations

One of the most important reasons users rely on an overtime calculator is compliance with labor laws. Overtime rules are not universal—they vary by country, industry, and sometimes even by job role. This creates uncertainty for both employees and employers, especially when trying to determine whether overtime pay is required and at what rate.

In many regions, labor laws define:

- The maximum number of regular working hours per day or week.

- When overtime becomes payable.

- The minimum overtime rate employers must apply.

- Exceptions for certain roles or salaried positions.

An overtime calculator helps bridge the gap between complex legal rules and everyday payroll practice. While it does not replace legal advice, it provides a reliable way to estimate overtime pay in line with common labor standards and company policies. This is especially useful when managing cross-border teams or adapting to regulatory changes.

For employers, using an overtime calculator supports compliance and reduces the risk of penalties or disputes. For employees, it offers clarity and confidence that their extra hours are being valued fairly.

Overtime Calculation by Country

Overtime calculation varies significantly by country, depending on local labor laws. This is why relying on a single overtime rate is not always accurate, and why an overtime calculator is especially useful when regulations differ.

- Saudi Arabia In Saudi Arabia, overtime pay is generally calculated at 1.5× the basic hourly wage for every hour worked beyond regular working hours. The same rate usually applies to work performed on weekly rest days or public holidays, unless company policy specifies a higher rate.

- United Arab Emirates In the UAE, overtime is typically paid at 1.25× for extra hours worked on regular workdays, increasing to 1.5× for night work or work performed on rest days, in line with UAE labor law.

- Other Countries In many countries, such as the United States and parts of Europe, overtime begins after 40 working hours per week, with a common rate of 1.5×, and higher rates applied for public holidays.

Because of these variations, choosing an overtime calculator that allows country-specific settings or flexible rate inputs is essential for accurate and compliant calculations.

When Is Overtime Not Paid?

Overtime pay is not applicable in every situation. Labor laws and company policies define specific cases where extra working hours do not qualify for overtime compensation. Understanding these scenarios helps prevent payroll misunderstandings and disputes.

Common cases where overtime is not paid include:

- Exempt salaried employees: Certain managerial or executive roles are classified as exempt from overtime pay.

- Not exceeding legal working hours: If total hours do not surpass the daily or weekly legal limit, overtime does not apply.

- Unauthorized overtime: Extra hours worked without formal approval may not be compensated.

- Time off in lieu: Some employers compensate overtime with paid time off instead of cash payment.

- Task-based or flexible contracts: In some agreements, compensation is based on output rather than hours worked.

This is why an overtime calculator should always be used alongside employment contracts and applicable labor laws—not as a standalone legal reference.

This is why an overtime calculator should always be used alongside employment contracts and applicable labor laws—not as a standalone legal reference.

Ready to Automate Payroll and Overtime Calculations with Wafeq?

Manual payroll calculations, overtime tracking, and compliance checks consume valuable time and expose businesses to errors.

With Wafeq Accounting Software, finance and HR teams can automate payroll workflows, ensure accurate overtime calculations, and maintain full compliance with local labor and tax regulations. Wafeq enables you to:

- Calculate salaries and overtime accurately based on approved working hours.

- Centralize payroll data within your accounting system.

- Reduce manual entries and payroll errors.

- Generate clear payroll and expense reports for audits and management.

- Scale payroll operations seamlessly as your business grows.

Read Also about: VAT Calculator – Instant Online VAT Calculation [Free tool]

An overtime calculator is not just a convenience tool—it answers real questions users actively search for: Am I being paid correctly? How much are my extra hours worth? Are overtime rates applied properly?

Throughout this guide, we’ve seen how an overtime calculator simplifies complex pay rules, applies correct overtime rates, reduces payroll errors, and supports compliance with labor laws. Whether you’re an employee reviewing a payslip or an employer managing payroll, the calculator offers clarity, speed, and confidence.

FAQs about Overtime Calculator

How do I calculate overtime pay?

Overtime pay is calculated by multiplying your hourly rate by the overtime rate (such as x1.5 or ×2) for every hour worked beyond regular working hours. An overtime calculator automates this process by applying the correct rate instantly based on your inputs.

What are considered overtime hours?

Overtime hours are any hours worked beyond the standard working schedule defined by labor law or company policy—often more than 8 hours per day or 40 hours per week, depending on the country.

Is overtime calculated on basic salary or total salary?

Overtime is usually calculated based on the basic hourly wage, not the total salary.

Is overtime calculated after 8 hours a day?

In many countries, overtime is calculated after working more than 8 hours per day, but this depends on local labor laws and company policies.

What is the minimum overtime rate?

The most common minimum overtime rate is 1.25× the regular hourly wage, depending on labor laws and employer policy.

Is overtime always paid at 1.5 times the regular rate?

Not always. While ×1.5 is common, some employers pay ×1.25, while others apply double pay for weekends, holidays, or night shifts. This is why many users rely on an overtime calculator to avoid confusion.

Is the overtime rate different for night shifts?

Yes, some labor laws apply higher overtime rates for night work compared to daytime hours.

Can I use an overtime calculator to check my payslip?

Yes. One of the most common uses of an overtime calculator is verifying payroll accuracy. Employees use it to confirm they were paid correctly for extra hours worked.

Do salaried employees get overtime pay?

This depends on labor laws and job classification. In some cases, salaried employees are exempt from overtime, while in others, they may still be eligible. An overtime calculator helps estimate pay, but legal eligibility should always be confirmed.

Is an overtime calculator legally binding?

No. An overtime calculator is a calculation tool, not a legal authority. Final eligibility depends on labor laws and contracts.

Gain Full Control Over Payroll and Overtime Costs.

Gain Full Control Over Payroll and Overtime Costs.

Payroll calculations Automatation, overtime tracking, and reporting in one unified accounting system

.png?alt=media)