Accounts Receivable Accountant: Responsibilities and Impact on Cash Flow

It was the first week of the quarter, and Layla sat at her desk watching the aging report climb higher with each passing day. Customers owed thousands, and deadlines for cash forecasts were looming. The finance team looked to her with that familiar question: “Are the receivables under control?”

As the company’s Accounts Receivable Accountant, Layla wasn’t just tracking numbers; she was the bridge between sales made on credit and the cash that keeps the business running. Their ability to collect quickly and reliably can make or break a company’s cash flow, and that’s exactly what this article will explore.

What Does an Accounts Receivable Accountant Do?

At a basic level, an Accounts Receivable Accountant is responsible for ensuring the business actually gets paid for the sales it makes on credit. But in practice, the role goes far beyond issuing invoices or following up on late payments.

A strong Accounts Receivable Accountant sits at the intersection of sales, finance, and cash flow, ensuring revenue recorded on paper turns into cash in the bank.

What is Accounts Receivable?

Accounts Receivable (AR) refers to the amounts a business is entitled to receive from its customers for goods or services delivered on credit. In simple terms, it represents money that has been earned but not yet collected.

When a company issues an invoice with deferred payment terms (such as 30 or 60 days), that amount is recorded as accounts receivable until the customer pays. Due to this, AR appears as a current asset on the balance sheet and plays a critical role in liquidity and cash flow management.

Accounts receivable is not just an accounting figure — it is a promise of cash. The faster that promise is fulfilled, the healthier the company’s cash position becomes. This is why managing AR effectively is essential for day-to-day operations, payroll, and growth.

Core Responsibilities of the Accounts Receivable Accountant

Here’s what the role typically includes:

- Issuing customer invoices accurately and on time Delayed or incorrect invoices are one of the most common reasons for late payments.

- Tracking customer balances and aging reports This includes monitoring how long invoices remain unpaid (30, 60, 90 days) and identifying collection risks early.

- Following up on collections Communicating with customers professionally to ensure payments are received according to agreed terms.

- Handling disputes and deductions Resolving pricing issues, missing documents, or service-related disputes that block payment.

- Recording receipts and reconciling accounts Ensuring payments are correctly posted, and customer balances remain accurate.

- Supporting cash flow forecasting Reliable receivables data helps finance teams predict incoming cash more accurately.

An Accounts Receivable Accountant doesn’t just manage transactions — they protect liquidity and reduce uncertainty.

An Accounts Receivable Accountant doesn’t just manage transactions — they protect liquidity and reduce uncertainty.

How Does an Accounts Receivable Accountant Improve Cash Collection?

Improving cash collection isn’t about chasing customers more aggressively — it’s about building a structured, disciplined process that removes friction from getting paid. This is where a skilled Accounts Receivable Accountant makes a measurable difference. Instead of reacting to late payments, they focus on preventing delays before they happen.

Key Ways They Improve Cash Collection

- Faster, more accurate invoicing Invoices sent on time — and without errors — get paid faster. According to best practices outlined by accounting bodies, invoice accuracy directly impacts the collection speed.

- Clear visibility into overdue balances Aging reports help prioritize follow-ups and identify risky customers early.

- Consistent collection follow-ups Structured reminders and documented communication reduce forgotten invoices.

- Early dispute resolution Most delayed payments are tied to unresolved disputes, not cash shortages.

- Alignment with sales and credit terms Ensuring customers are billed according to agreed pricing and payment terms reduces friction.

A company doesn’t need more sales to improve cash flow — it needs better collection discipline. That discipline is built, monitored, and enforced by the Accounts Receivable Accountant.

A company doesn’t need more sales to improve cash flow — it needs better collection discipline. That discipline is built, monitored, and enforced by the Accounts Receivable Accountant.

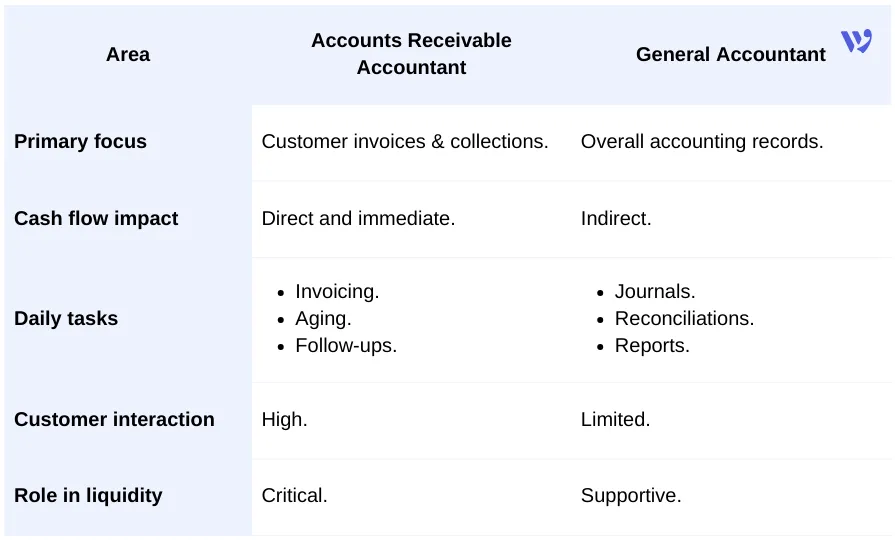

Accounts Receivable Accountant vs General Accountant (Key Differences)

Many businesses — especially small and growing ones — assume that a General Accountant can handle everything, including customer collections. While there is some overlap, the focus and impact of each role are very different. An Accounts Receivable Accountant is specialized. Their primary mission is simple but critical: turning credit sales into collected cash.

Accounts Receivable Lifecycle: From Invoice to Cash

Managing accounts receivable is a process, not just a task. Each stage ensures the company collects payments on time while maintaining strong customer relationships. A skilled Accounts Receivable Accountant oversees this lifecycle carefully.

- Invoice Creation Invoices are generated based on delivered goods or services. Accuracy is key — errors delay payment and create disputes.

- Invoice Delivery Invoices are sent via email, ERP systems, or customer portals. Prompt delivery ensures the payment process starts on time.

- Payment Tracking Outstanding invoices are monitored using aging reports, which categorize receivables by the number of days overdue. This helps prioritize collection efforts.

- Follow-Up and Collection The AR accountant follows up with customers professionally, sending reminders or addressing queries to encourage timely payment.

- Dispute Resolution Any disputes or discrepancies are resolved quickly to prevent payment delays.

- Payment Receipt and Posting Once payment is received, it’s recorded in the accounting system and reconciled with the customer account.

- Reporting and Analysis AR data is analyzed to identify trends, assess risk, and improve cash flow forecasting.

A well-managed AR lifecycle reduces late payments, improves cash flow, and strengthens customer trust, all critical for business growth.

A well-managed AR lifecycle reduces late payments, improves cash flow, and strengthens customer trust, all critical for business growth.

Common AR Problems That Delay Cash Collection and How an AR Accountant Solves Them

Even with a solid process, companies face hurdles that delay cash collection. A skilled Accounts Receivable Accountant knows how to tackle them efficiently.

- Late Payments Customers often pay after the due date, which affects cash flow, but an AR Accountant reduces delays by monitoring aging reports and sending timely reminders.

- Invoice Errors Mistakes in invoices, such as incorrect amounts or missing details, can hold up payments, so an AR Accountant ensures each invoice is accurate before sending it.

- Disputes and Deductions Customer disputes or deductions can slow collections, and an AR Accountant resolves them quickly through professional communication and prompt investigation.

- Poor Record Keeping Disorganized records make it difficult to track payments, whereas an AR Accountant keeps accounts up to date, posts payments accurately, and reconciles them regularly.

- Lack of Cash Flow Visibility Without clear data, management struggles to forecast cash inflows, but an AR Accountant provides detailed AR reports for accurate forecasting and liquidity planning.

How to Improve Accounts Receivable and Collect Payments Faster

Effectively managing accounts receivable is all about structure, consistency, and proactive follow-up. A skilled AR accountant ensures that every stage — from invoice issuance to cash posting — runs smoothly, minimizing delays and improving cash flow.

- Send Accurate Invoices Immediately Invoices should be error-free and sent as soon as goods or services are delivered, because the faster the invoice reaches the customer, the faster the payment can arrive.

- Track and Prioritize Overdue Accounts Use aging reports to categorize outstanding invoices and focus collection efforts on high-risk accounts first.

- Maintain Clear Communication with Customers Professional, regular reminders and open communication prevent misunderstandings and ensure timely payments.

- Resolve Disputes Quickly Address errors, discrepancies, or pricing issues immediately to prevent delayed payments.

- Leverage Technology Use accounting software or ERP systems to automate invoicing, track payments, and generate reports for better cash visibility.

- Regularly Review Customer Credit Terms Adjust credit limits and payment terms based on customer payment history to reduce risk.

How Wafeq Helps an AR Accountant Manage Accounts Receivable Efficiently

In businesses that rely on credit sales or long-term customer relationships, keeping track of each customer’s balance isn’t optional — it’s essential. This is where Wafeq gives Accounts Receivable Accountants real visibility and control.

With Wafeq’s Customer Balance Summary Report, AR teams can quickly see how much each customer owes over any selected period. The report clearly shows the opening balance, total debit and credit movements, and the closing balance — all in one view.

This makes it easy to answer critical day-to-day questions, such as:

- How much is outstanding from each customer at the end of the period?

- Has the customer’s balance increased or decreased since the beginning of the period?

- Did the customer make payments, or has their outstanding amount grown?

Wafeq also allows AR accountants to customize the report based on specific timeframes, filter data by branches, cost centers, or projects, and export the report in Excel or PDF format.

This flexibility helps teams:

- Monitor receivables more closely.

- Follow up faster.

- Make informed collection decisions, without relying on manual tracking or fragmented spreadsheets.

Read Also: How Does Accounts Payable Control Vendor Payments?

Managing accounts receivable efficiently can be challenging, even for an experienced AR Accountant. From issuing accurate invoices to tracking overdue payments, every step requires attention and precision. Wafeq simplifies this process by providing tools that automate repetitive tasks, improve visibility, and support faster cash collection — helping businesses stay on top of their receivables effortlessly.

FAQ About Accounts Receivable and Accounts Receivable Accountant

What is the main role of an Accounts Receivable Accountant?

The AR Accountantء is responsible for managing customer invoices, monitoring outstanding payments, resolving disputes, and ensuring cash is collected on time to maintain healthy cash flow.]

How can businesses reduce late payments?

By issuing accurate invoices, tracking aging reports, sending timely reminders, and resolving disputes quickly — all of which are managed efficiently by an AR Accountant.

What tools help Accounts Receivable management?

Accounting software like Wafeq automates invoicing, tracks payments, provides reports, and integrates with ERP systems, simplifying AR tasks for accounts receivable.

How does an Accounts Receivable Accountant impact cash flow?

By ensuring invoices are paid on time and that overdue accounts are minimized, the AR Accountant directly supports the company's liquidity and financial stability.

Is accounts receivable management related to company size?

Yes. Smaller companies may combine roles, but larger or cash-sensitive businesses benefit from a dedicated AR accountant to manage AR efficiently.

Let Wafeq help your AR Accountant manage invoices, track payments, and collect cash faster, all from a single, easy-to-use platform. Start optimizing your AR process today!

Let Wafeq help your AR Accountant manage invoices, track payments, and collect cash faster, all from a single, easy-to-use platform. Start optimizing your AR process today!

.png?alt=media)