Overview of Accounting in the Modern World

Accounting involves keeping track of all the financial transactions related to a business. These transactions are summed up, analyzed, and reported to supervisory authorities, regulatory bodies, and tax collection bureaus as part of the accounting process. The financial statements used in accounting are a summary of a firm's management, financial standing, and cash flows over an accounting period.

Leave Accounting on Us

Start using Wafeq today for free and let us manage your accounting while you have more time to develop your business.

Overview of accounting today

Introduction to Accounting

Accounting is a vital part of almost every business. In a small company, it might be done by a bookkeeper or an accountant. A larger company usually performs it through a large finance department with dozens of employees.

The reports made by different accounting types, like cost accounting and managerial accounting, are beneficial for helping business leaders make good decisions.

The financial statements of a large company are short, consolidated reports that summarize its operational processes, financial position, and cash flow over a certain period. These reports are composed of thousands of individual financial transactions. So, all professional accounting categorizations result from years of study, challenging exams, and at least a few years of real-world accounting experience.

How accounting evolved

Almost as long as money has been around, accounting has been around. Accounting has a long history that goes back to Mesopotamia, Egypt, and Babylon. During the Roman Empire, the government kept all detailed records of how much money it had.

People call Luca Pacioli "The Father of Accounting and Bookkeeping" because of what he did to help make accounting a profession. In 1494, he wrote a book about how to keep books using the double-entry system.

Modern accounting has only been a job since the early 1800s. The Institute of Chartered Accountants in England and Wales officially recognized modern accounting as a profession in 1880.

This institute made several of the systems that accountants use today. The Industrial Revolution had a lot to do with how the institute came to be. Merchants not only had to keep track of their records, but they also tried to stay out of debt.

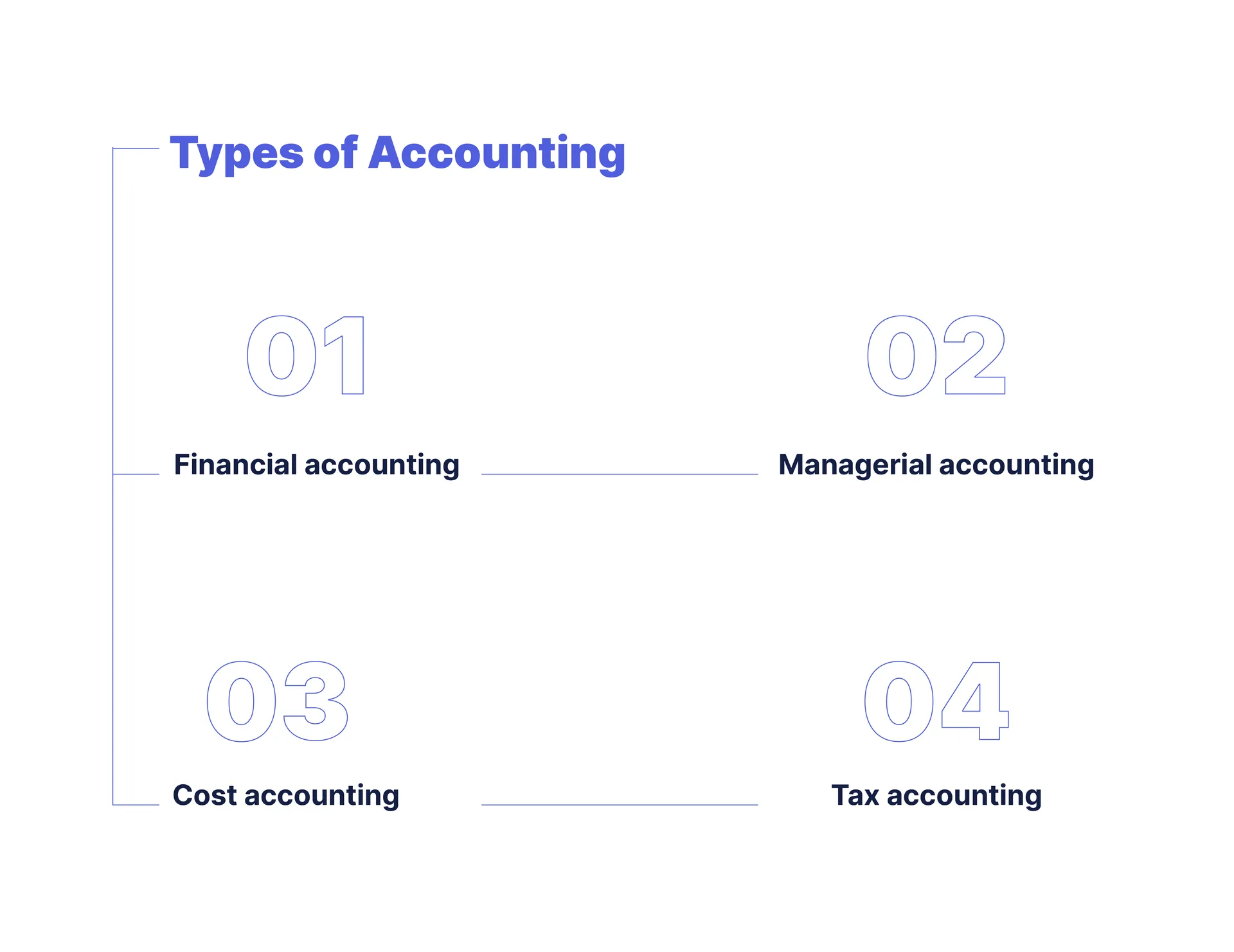

Different types of accounting

Accountants could be instructed to keep track of specific transactions or work with certain data sets. Because of this, the majority of accountants can be put into a few broad categories.

Financial Accounting

Financial accounting is the process of making financial statements, such as quarterly and yearly reports. The balance sheet, financial statements, and cash flow statements are all ways, to sum up the results of all financial transactions that happen during an accounting period. An external CPA enterprise audits the financial statements of most businesses once a year.

As part of their debt covenants, lenders usually want to see the findings of an external audit once a year. Because of this, most companies have audits every year.

Managerial accounting

Financial accounting and managerial accounting use a lot of the same information but they organize and use it differently. In managerial accounting, for example, an accountant makes monthly or quarterly reports that a company's management team can use to decide how to run the business.

Managerial accounting also includes a lot of other aspects of accounting, like budgeting, forecasting, and different tools for analyzing finances. Primarily, this includes any information that could be useful to management.

Cost accounting

In the same way that managerial accounting helps businesses decide how to run, cost accounting helps businesses decide how to spend their money.

Cost accounting basically looks at all of the expenses that go into making a product. This data is used by economists, management staff, corporate executives, and accountants to figure out how much their products should cost. In cost accounting, money is seen as an economic aspect of production. In financial accounting, on the other hand, money is seen as a measure of how well a company is doing economically.

Tax accounting

Tax accountants frequently rely on a distinct set of procedures than financial accountants to report on a company's financial situation. Depending on what kind of return is being filed, these rules are established at the federal, state, or local level.

Tax accountants try to find a balance between following reporting rules and minimizing a firm's tax liability by making smart, business choices. Often, a tax accountant is in charge of a company's entire tax process, including creating the organization chart, operations, compliance, reporting, and the payment of taxes.

If you are running a business you can use Wafeq to manage all your business accounting requirements.

The Accounting career

Usually, bookkeepers can take care of basic accounting tasks, but certified accountants do most of the advanced accounting. They hold titles like Certified Public Accountant (CPA) or Certified Management Accountant (CMA).

The "Big Four" are an essential part of being an accountant. These four biggest accounting firms offer auditing, consulting, tax advice, and more services. Public accounting is made up of these firms and a lot of smaller ones as well. Most of the time, they give advice on financial and tax accounting.

Accounting jobs can be very different based on the sector, department, and niche. Some job titles that might be relevant are:

Auditor (internal/external)

He or she is in charge of ensuring that reporting requirements are met and that the company's assets are safe.

Forensic Accountant

They keep a close eye on all a business's internal and external transactions to find out what is going on.

Tax accountant

They plan the best way for a business to be set up so that it pays the least amount of taxes and makes sure that tax reporting rules are followed.

Managerial accountant

These accountants look at financial transactions and make well-thought-out, strategic suggestions, usually about how to make commodities.

IT analyst/accountant:

They take care of the computer system and software that are used to process and store accounting records.

Controller

The controller is in charge of the accounting functions that includes financial reporting, accrued expenses, receivable accounts, and procurement.

Guidelines for accounting

When making financial statements in the Kingdom of Saudi Arabia IFRS Accounting Standards are required for all publicly accountable entities.

International Financial Reporting Standards (IFRS) are a set of accounting standards that govern how particular types of transactions and events should be reported in financial statements.

Tax accounts could also include state or county taxes, depending on where the business is located and how it is run. Foreign businesses must follow tax rules in the countries where they have to file a return.

Best Accounting Software to Use

Generally, accountants use software to help them in their jobs. Some accounting software, like Wafeq, Quickbooks , or Qoyod is thought to be better for small and medium businesses. While larger companies' solutions to meet their specific reporting needs are much more complicated, such as products from Oracle, or Netsuite.

The Cycle of Accounting

Financial accountants usually work in a cycle where the same steps happen in the same order every reporting period. The accounting cycle takes raw information about transactions, enters it into an accounting system, and runs accurate and useful financial reports.

The accounting cycle consists of:

Collect information about business transactions from receipts, bank statements, receipts, payment requests, checks that haven't been cashed, credit card statements, and other sources.

Submit journal entries to the ledger accounts for the things from Step 1, matching up with external documents whenever feasible.

Prepare a trial balance that hasn't been changed to ensure that all debits and credits add up to zero and that all-important general ledger accounts feel natural.

At the end of the period, post adjusting journal entries to reflect any changes that need to be created to the trial balance run in Step 3.

Make the modified trial balance to make sure that these financial balances are correct and reasonable in a meaningful way.

Organize the financial statements to show a summary of everything that happened during the reporting period.

Difference between cash method and accrual method

Financial accounts can follow either of two different sets of rules. The first, the accrual basis method of accounting recognizes business revenue and matching expenses when they are generated—not when money changes hands. IFRS spells out these rules. Public companies must follow them, and larger companies mostly use them.

The cash method of accounting is used for the second set of rules. Instead of writing down a transaction when it happens, the cash method says that it should only be written down when cash changes hands.

The cash method of accounting is often used by smaller companies and other groups that don't have to use the accrual method. This is because the cash method is easier to use.

The distinction between these two ways of keeping track of money is how accruals are handled. With the accrual method of accounting, it makes sense that accruals are needed. With the cash method, there is no need to record or keep track of accruals.

Read more in detail about Cash and Accrual accounting.

Significance of Accounting

Accounting is a back-office task where employees may not have direct interaction with customers, product designers, or manufacturing. But accounting is a key part of a company's strategic planning, economic expansion, and meeting legal requirements.

Accounting is needed for a business to grow. Forecasting can't help a company make intelligent financial decisions if they don't know how its business is doing. Without accounting, a corporation wouldn't know which products sell the most, how much money is made in each department, or what costs are keeping profits from going up.

Accounting is needed for money to flow. External investors want to be sure that the company knows what it is doing. Before giving a company private funding, investors usually want to see its financial statements, which are often audited, so they can figure out how healthy the business is overall. The same rules apply to financing with debt. As part of the loan underwriting and review process, banks and other lending organizations often need financial statements that follow accounting rules.

For the owner to exit, accounting is needed. Small companies that want to be bought or merged often have to show their financial statements as a part of the deal. Instead of just shutting down a business, a company owner may try to "cash out" of their position and get paid for building a business. Accounting records are the basis for figuring out how much a company is worth.

For payments to be made, accounting is needed. A company will always have debt, and part of being responsible for that debt is making payments to the right people on time. If these business relationships aren't taken care of, a company may end up with a major supplier or vendor. Accounting lets a business always understand who it owes money to and when that money is due.

To get paid, you need to do accounting. A business may agree to give its customers credit. Instead of getting cash from a customer at the time of a contract, it may offer trade credit terms like "net 30." Without accounting, it might be hard for a company to keep a record of who owes it money and exactly when it will get that money.

Major responsibilities of an accountant

Accountants help businesses keep financial records that are accurate and up-to-date. They are in charge of keeping track of a company's daily transactions and turning them into financial statements like the balance sheet, income statement, and cash flow statements. Accountants also do other things, like perform regular audits or make management reports when needed.

Skills required to become an accountant

Accountants come from many different kinds of backgrounds. In general, though, attention to detail is a key part of accounting, because accountants must be able to find and fix small mistakes or differences in a company's books.

To help solve problems, you also need to be able to think logically. Because computers and calculators are so common, math skills are helpful, but they are not as important as they used to be.

Accounting is indispensable for investors

Accountants are crucial to modern financial markets because of the work they do. Without accounting, investors wouldn't be able to trust that financial information is correct or up-to-date, and company leaders wouldn't have the information they need to manage risk control or plan projects.

Regulators also depend on accountants for essential tasks like getting company auditors' opinions on annual filings.

.png?alt=media)