How to Get a Tax Residency Certificate in UAE: Cost, Process & Requirements

When a company expands across borders, tax residency quickly becomes more than a legal concept — it becomes a business requirement. Multinational groups, holding companies, and regional headquarters operating from the UAE are often asked by foreign tax authorities, banks, or partners to formally prove where they are tax resident. Without clear documentation, this can delay transactions, trigger compliance risks, or even lead to double taxation.

This is where the UAE Tax Residency Certificate (TRC) plays a critical role. Issued by the Federal Tax Authority, the certificate serves as official proof of tax residency and supports treaty claims, regulatory filings, and cross-border business operations. In this guide, we break down:

- How businesses can obtain a Tax Residency Certificate in the UAE.

- TRC cost.

- TRC Eligibility requirements.

- How the process differs for companies and individuals.

What Is a Tax Residency Certificate in the UAE? (TRC Explained for Businesses)

A Tax Residency Certificate (TRC) is an official document issued by the UAE Federal Tax Authority (FTA) that confirms a company is considered a tax resident in the UAE for a specific financial year (12-month period).

For businesses, the certificate is primarily used to:

- Claim benefits under Double Taxation Avoidance Agreements (DTAAs) signed between the UAE and other countries.

- Demonstrate tax residency to foreign tax authorities.

- Support cross-border transactions, dividend distributions, and profit repatriation.

- Meet compliance requirements requested by banks, auditors, or international partners

The certificate does not state that a company pays corporate income tax in the UAE. Instead, it confirms that the company is resident for tax purposes, based on its incorporation, management, and economic presence in the country.

The UAE has an extensive network of tax treaties, and the TRC is the primary document used to access treaty protection, such as reduced withholding tax rates or exemption from taxation in another jurisdiction.

How to Become a Tax Resident of the UAE (Business Perspective)

For companies, tax residency in the UAE is not automatic. It is assessed based on where the business is established, managed, and effectively operated. The Federal Tax Authority looks at substance, not just registration.

A company is generally considered a UAE tax resident if one or more of the following conditions are met:

1. The Company Is Incorporated or Registered in the UAE

This includes:

- Mainland companies.

- Free Zone entities.

- UAE holding companies.

Incorporation alone is important, but it is not always sufficient if the company lacks a real economic presence.

Incorporation alone is important, but it is not always sufficient if the company lacks a real economic presence.

2. Place of Effective Management Is in the UAE

If the company is managed and controlled from the UAE, this strongly supports tax residency status. The FTA evaluates where:

- Strategic decisions are made.

- Board meetings are held.

- Senior management operates.

- Key commercial and financial decisions are executed.

3. Economic Substance and Business Activity

Authorities may assess whether the company has:

- A physical office or registered premises.

- Employees or management based in the UAE.

- Active operations, contracts, or revenue-generating activities.

- Local bank accounts and accounting records.

This aligns closely with Economic Substance Regulations (ESR) expectations and reinforces the company’s claim to UAE tax residency.

How to Get a Tax Residency Certificate in the UAE (Online Application Process)

The UAE has made the process of obtaining a Tax Residency Certificate (TRC) fully digital, allowing companies to apply online through the EmaraTax portal, which the Federal Tax Authority manages. For businesses, the process is structured, transparent, and largely document-driven. The following is the Step-by-Step Application Process:

- Create or access an EmaraTax account The company must have an active EmaraTax profile linked to its trade license and authorized signatory.

- Select the Tax Residency Certificate service From the dashboard, navigate to Other Services and choose Tax Residency Certificate.

- Choose the applicant type

- Legal person (company)

- Indicate whether the company is registered for UAE tax and holds a Tax Registration Number (TRN)

4. Define the certificate purpose

- For double tax treaty purposes.

- For domestic or other official purposes.

5. Select the financial period The certificate is issued for a specific 12-month period, which must be clearly stated in the application. 6. Upload required supporting documents These typically include:

- Trade license.

- Memorandum of Association.

- Proof of place of effective management.

- Audited financial statements or bank confirmation.

- Office lease or Ejari (if applicable)

7. Pay the applicable fees Fees vary depending on the company’s tax registration status and are paid directly through the portal. 8. Submit and track the application Once submitted, the application can be tracked online. If approved, the certificate is issued electronically and can be downloaded directly.

In most cases, processing to get a Tax Residency Certificate in the UAE takes around 5 business days, provided the documentation is complete and consistent.

In most cases, processing to get a Tax Residency Certificate in the UAE takes around 5 business days, provided the documentation is complete and consistent.

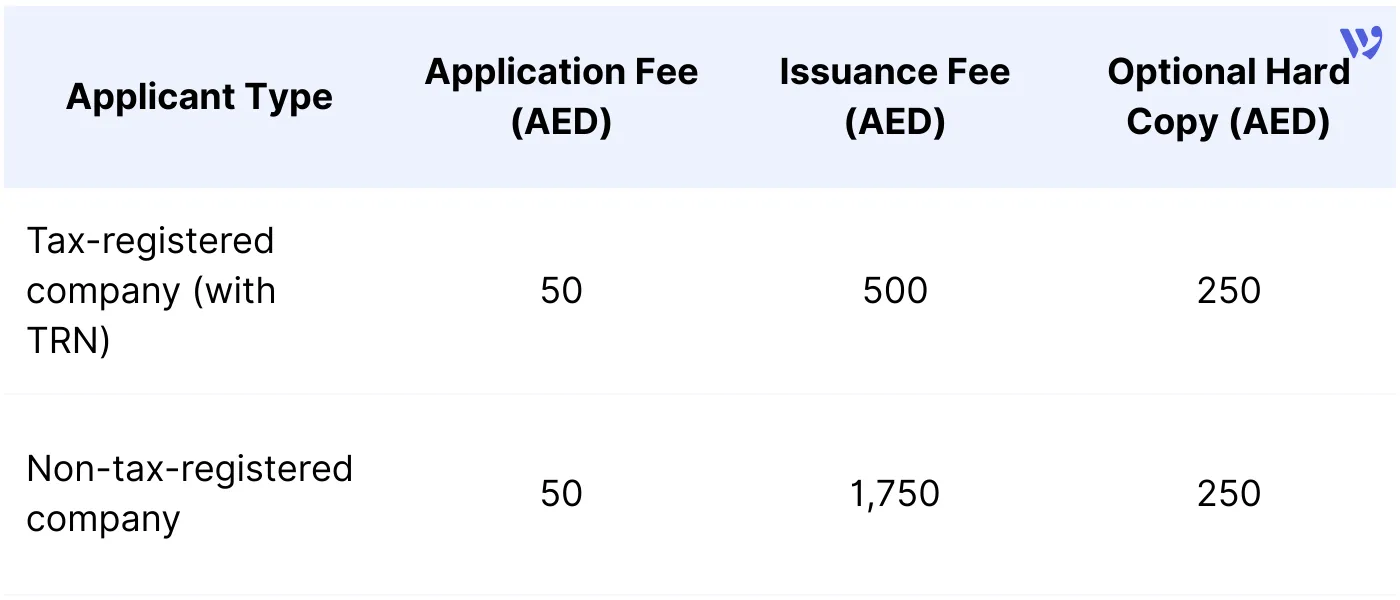

How Much Is the Tax Residency Certificate in the UAE? (Costs & Fees)

The cost of a Tax Residency Certificate (TRC) in the UAE is fixed and regulated by the Federal Tax Authority. The total amount depends mainly on whether the company is registered for tax purposes and whether a hard copy of the certificate is requested.

It’s important to note that all fees are non-refundable, even if the application is rejected due to incomplete documentation.

Official TRC Fees for Companies

The cost of a Tax Residency Certificate (TRC) in the UAE is fixed and regulated by the Federal Tax Authority. The total amount depends mainly on whether the company is registered for tax purposes and whether a hard copy of the certificate is requested.

It’s important to note that all fees are non-refundable, even if the application is rejected due to incomplete documentation.

Official TRC Fees for Companies

Key points to keep in mind:

Key points to keep in mind:

- The AED 50 application fee is paid at the time of submission.

- The issuance fee is paid only after preliminary approval.

- The certificate is issued electronically by default.

- A hard copy is optional and typically used for foreign authorities requiring physical documentation.

- From a cost perspective, companies that are already registered with the FTA benefit from a significantly lower issuance fee.

What are the required documents for Companies Applying for a Tax Residency Certificate?

Submitting complete and consistent documentation is one of the most critical factors in successfully obtaining a Tax Residency Certificate in the UAE. The Federal Tax Authority focuses on documents that demonstrate legal existence, effective management, and economic presence within the country.

While exact requirements may vary depending on the company’s structure and activity, the following documents are commonly required:

1. Core Corporate Documents

- Valid trade license.

- Memorandum of Association (MOA) or Articles of Association.

- Passport and Emirates ID of the authorized signatory.

Know more about: Top 5 Company Setup Providers in the UAE and How to Choose the Right One

2. Proof of Effective Management

- Board resolutions or minutes showing decision-making in the UAE.

- Power of attorney or management agreements (if applicable)

- Organizational chart highlighting UAE-based management.

3. Financial and Operational Evidence

- Audited financial statements or a bank confirmation letter.

- UAE bank account statements.

- Active contracts or invoices supporting local operations.

4. Proof of Physical Presence

- Office lease agreement or Ejari.

- Utility bills or office address confirmation.

- Companies applying for treaty purposes are often subject to higher scrutiny, particularly where management or shareholders are located outside the UAE.

- Ensuring alignment between documents significantly reduces processing delays and rejection.

- Companies applying for treaty purposes are often subject to higher scrutiny, particularly where management or shareholders are located outside the UAE.

- Ensuring alignment between documents significantly reduces processing delays and rejection.

Tax Residency Certificate for Individuals (Brief Overview)

While this guide focuses primarily on businesses, individuals may also apply for a UAE Tax Residency Certificate, subject to specific residency and presence conditions.

For individuals, tax residency is generally assessed based on physical presence in the UAE and supporting ties to the country.

An individual may qualify for a Tax Residency Certificate if they meet one of the following criteria:

- 183 days or more of physical presence in the UAE within 12 months.

- 90 days or more in the UAE, provided the individual has:

- A permanent place of residence.

- Employment or business activity in the UAE.

- Supporting financial and residency documentation.

In addition to passport and visa documents, individuals are usually required to submit:

- UAE entry and exit records.

- Emirates ID.

- Tenancy contract or proof of accommodation.

- Employment contract or business ownership documents.

Certificates issued based on 90 days of presence are often limited to domestic purposes and may not always be accepted by foreign tax authorities for treaty claims. For this reason, individuals seeking treaty benefits are generally advised to meet the 183-day threshold where possible.

Certificates issued based on 90 days of presence are often limited to domestic purposes and may not always be accepted by foreign tax authorities for treaty claims. For this reason, individuals seeking treaty benefits are generally advised to meet the 183-day threshold where possible.

Key Implications of the Tax Residency Certificate for Businesses

For businesses operating across borders, the UAE Tax Residency Certificate is more than a compliance document — it is a strategic tool that directly affects taxation, cash flow, and regulatory positioning.

1. Access to Double Taxation Avoidance Agreements (DTAAs)

The primary implication of obtaining a TRC is the ability to claim treaty benefits under the UAE’s extensive double tax treaty network. These benefits often include:

- Reduced or zero withholding tax on dividends, interest, and royalties.

- Protection from being taxed twice on the same income.

- Clearer tax treatment for cross-border transactions.

Without a valid TRC, foreign tax authorities may deny treaty benefits, even if the company is incorporated in the UAE.

Without a valid TRC, foreign tax authorities may deny treaty benefits, even if the company is incorporated in the UAE.

2. Stronger Position with Foreign Tax Authorities

Many tax authorities now require formal proof of tax residency, not just a trade license or incorporation certificate, especially relevant for holding companies, IP structures, and regional headquarters. A UAE TRC:

- Strengthens the company’s legal position.

- Reduces the risk of reclassification as a foreign tax resident.

- Supports responses to tax audits or information requests.

3. Banking, Compliance, and Transactional Clarity

Having an active TRC available helps avoid delays and compliance friction, which is why Banks, auditors, and international partners increasingly request tax residency documentation as part of:

- Account opening or review processes.

- Dividend distribution approvals.

- Group restructuring or M&A transactions.

Common Mistakes Businesses Make When Applying for a UAE TRC

- 1. Assuming incorporation alone is sufficient Many companies believe that holding a UAE trade license automatically qualifies them for tax residency. In reality, lack of effective management or economic substance is one of the top reasons for rejection.

- Selecting the wrong certificate purpose Choosing “domestic purposes” instead of “double tax treaty purposes” can result in a certificate that cannot be used internationally, even if all other conditions are met.

- Inconsistent or weak documentation Mismatches between management location, bank activity, and financial statements can raise red flags and delay approval.

- Applying too early The certificate is issued for a specific 12-month period. Applying without sufficient operational history often leads to rejection.

Read About: How to register corporation tax in the UAE.

Read Also: Understanding UAE E-Invoicing: A Practical Guide for Companies.

For companies operating in the UAE or managing cross-border activities, the UAE Tax Residency Certificate (TRC) is no longer just a supporting document—it is a core compliance and tax-planning requirement. It plays a critical role in accessing double tax treaty benefits, reducing withholding tax exposure, and demonstrating economic substance and tax residency to foreign tax authorities.

Understanding who qualifies, how residency is assessed, and how the certificate is issued allows businesses to plan their corporate structure, substance, and reporting obligations with confidence. More importantly, aligning financial records, tax registrations, and supporting documentation ensures a smoother application process and minimizes the risk of delays or rejection. As tax authorities globally increase scrutiny on residency claims, UAE-based businesses must treat tax residency not as a one-time application, but as an ongoing compliance position supported by accurate accounting, timely filings, and clear operational substance.

FAQ about TRC in the UAE

How long does it take to get a Tax Residency Certificate in the UAE?

Typically, 5 business days, provided all documents are complete and accurate.

Is the UAE Tax Residency Certificate valid internationally?

Yes — if issued for double tax treaty purposes. Foreign tax authorities may not accept Domestic-purpose certificates.

Can a Free Zone company get a Tax Residency Certificate?

Yes. Free Zone companies are eligible as long as effective management and economic substance requirements are met.

Does the UAE Tax Residency Certificate need to be renewed?

Yes. The certificate is valid for one financial year only and must be renewed annually.

Ensure your business meets UAE tax residency requirements clearly and confidently. Use a structured accounting system that supports clean records, consistent documentation, and audit-ready reporting.

Ensure your business meets UAE tax residency requirements clearly and confidently. Use a structured accounting system that supports clean records, consistent documentation, and audit-ready reporting.

.png?alt=media)