Payroll Accountant: How to Become a Professional in Payroll Management

At the end of every pay cycle, accuracy becomes non-negotiable. A single miscalculation in payroll can lead to employee dissatisfaction, compliance risks, and unnecessary administrative effort. This is why payroll management is not merely a routine task, but a critical financial responsibility.

Here’s a quick snapshot of what you’ll learn in this article:

- Role of a payroll accountant.

- How payroll is calculated accurately.

- Recording payroll entries correctly.

- Tools like Wafeq for automation.

- Common payroll challenges and solutions.

- How to become a payroll accountant.

Who is a Payroll Accountant?

A payroll accountant is the financial professional responsible for ensuring employees are paid accurately and on time. They manage salary calculations, tax withholdings, deductions, and benefits, acting as the bridge between HR and finance departments. Beyond simple paycheck processing, payroll accountants ensure compliance with labor laws and tax regulations, preventing costly errors or legal issues.

What are the Key Responsibilities of a Payroll Accountant?

Payroll accountants handle multiple tasks, including:

- Salary Calculation: Ensuring each employee’s pay matches hours worked and contractual agreements.

- Tax Compliance: Calculating and submitting income taxes, social security contributions, and other statutory deductions.

- Benefits Administration: Managing health insurance, pensions, and other employee perks.

- Record Keeping: Maintaining accurate payroll records for audits and reporting.

- Reporting & Reconciliation: Preparing payroll reports and reconciling discrepancies to avoid errors.

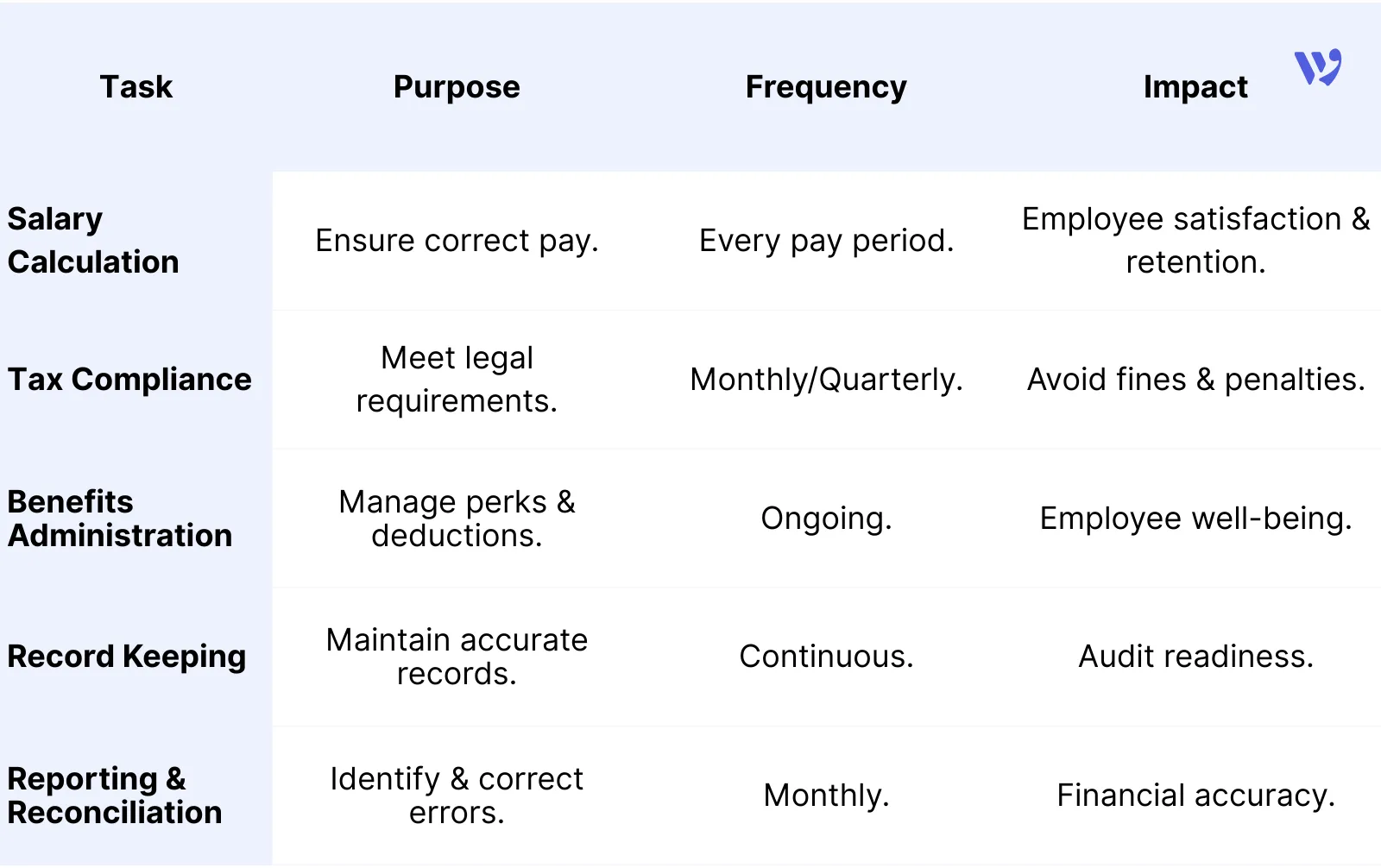

Here’s a simple comparison table for clarity:

How Payroll is Calculated Accurately

Calculating payroll might seem straightforward—hours worked multiplied by the rate—but in reality, it’s a complex process that requires precision. A payroll accountant ensures every paycheck reflects gross pay, deductions, and net pay accurately. Here’s how they do it:

- Gross Pay Calculation: The total earnings before any deductions, including overtime, bonuses, and allowances.

- Statutory Deductions: Taxes, social security, and other government-mandated contributions.

- Voluntary Deductions: Health insurance premiums, retirement contributions, or other employee-elected benefits.

- Net Pay Determination: Gross pay minus all deductions equals what the employee takes home.

- Verification & Reconciliation: Comparing payroll records with timesheets and contracts to ensure consistency.

Common formula for net pay:

Common formula for net pay:

Net Pay = Gross Pay – (Statutory Deductions + Voluntary Deductions)

Accuracy is crucial. Even a small error can lead to legal consequences, employee dissatisfaction, or financial loss. Tools like automated payroll software can help reduce errors, but the payroll accountant is still responsible for final checks and compliance.

Understanding Payroll Entries

For businesses, processing payroll isn’t just about sending checks—it’s also about recording payroll entries accurately in the accounting system. Payroll entries ensure that salaries, taxes, and benefits are properly tracked in the company’s financial records.

How Payroll Entries Work:

For businesses, processing payroll isn’t just about sending checks—it’s also about recording payroll entries accurately in the accounting system. Payroll entries ensure that salaries, taxes, and benefits are properly tracked in the company’s financial records.

- Gross Salary Entry: Record the total salary expense for employees. Debit: Salary Expense Credit: Salary Payable

- Tax and Deduction Entries: Record mandatory and voluntary deductions such as income tax, social security, health insurance, and retirement contributions. Debit: Salary Payable Credit: Tax Payable / Benefits Payable / Employee Deductions

- Net Salary Payment: Record the payment made to employees after all deductions. Debit: Salary Payable Credit: Bank / Cash

Example Payroll Journal Entry: | Account | Debit (AED) | Credit (AED) |

Example Payroll Journal Entry: | Account | Debit (AED) | Credit (AED) |

| Salary Expense 50,000

| Salary Payable 50,000

| Salary Payable | 50,000

| Tax Payable 5,000

| Bank 45,000

|Salary Payable 45,000

|Bank 45,000

How a Payroll Accountant Impacts Business Success

Businesses often search for answers to questions like: “Why do I need a payroll accountant?” or “How can payroll errors affect my company?” The role of a payroll accountant goes beyond calculating salaries—they directly affect compliance, cash flow, and employee satisfaction.

Here’s why this role is critical:

- Avoid Legal Penalties: Payroll mistakes, such as incorrect tax deductions or late filings, can trigger fines from government authorities. A payroll accountant ensures compliance with labor laws and tax regulations, protecting your business from costly mistakes.

- Cash Flow Management: Accurate payroll calculations prevent overpayment, underpayment, and unexpected payroll liabilities, keeping your company’s finances predictable.

- Employee Retention: Employees notice errors quickly. Timely and accurate payroll improves trust, morale, and retention.

- Streamlined Processes: Payroll accountants use software and systems to automate repetitive tasks, reducing manual errors and freeing HR and finance teams to focus on strategic activities.

Tools and Techniques for Accurate Payroll (How to calculate payroll efficiently and accurately)

Businesses want solutions that reduce errors, save time, and ensure compliance. Here’s how payroll accountants achieve precision:

- Payroll Software: Modern tools such as Wafeq, ADP, or Gusto automate salary calculations, tax deductions, and benefit management. Wafeq, in particular, is designed for businesses in KSA, UAE, and the GCC, ensuring compliance with local labor laws and tax regulations customized to each country while streamlining payroll for HR and finance teams. These platforms minimize manual errors and produce ready-to-submit reports.

- Timesheet Integration: Linking payroll systems with digital timesheets ensures accurate recording of hours worked, overtime, and leave.

- Tax & Legal Updates: Payroll accountants stay up to date on changing labor laws and tax regulations to avoid mistakes that could result in fines.

- Automated Checks & Balances: Built-in validation rules in payroll systems flag discrepancies before payments are processed.

- Regular Audits: Routine internal audits and reconciliations confirm payroll data matches employee records, contracts, and statutory requirements.

Common Payroll Challenges and How Payroll Accountants Solve Them

Many businesses search for answers to questions like: “Why is payroll complicated?” or “What are common payroll mistakes?” Payroll can be surprisingly tricky, even with modern software, and errors can cost companies time, money, and employee trust. A payroll accountant plays a crucial role in preventing these problems. The following are Common Payroll Challenges:

- Incorrect Tax Deductions: Miscalculating income tax or social security contributions can lead to fines. Payroll accountants ensure compliance by staying up to date on local tax laws.

- Late or Missed Payments: Delays frustrate employees and damage morale. Payroll accountants use automated schedules and checks to guarantee timely payments.

- Complex Benefits and Allowances: Calculating bonuses, overtime, or allowances incorrectly can create disputes. Payroll accountants verify all calculations against contracts and company policies.

- Human Errors in Manual Payroll: Manual data entry is prone to mistakes. Payroll accountants combine automation with cross-checks to minimize errors.

- Regulatory Changes: Labor laws and tax regulations change frequently. Payroll accountants adapt payroll processes to remain compliant.

How Payroll Accountants Solve These Issues:

- Automation with Tools like Wafeq: Payroll accountants use an accounting software like Wafeq to automatically calculate salaries, taxes, and benefits while generating accurate reports.

- Routine Reconciliation: Comparing payroll data with timesheets, contracts, and HR records to catch errors before payments are issued.

- Continuous Training and Updates: Staying current with new labor laws and tax updates prevents compliance issues.

- Clear Communication: Coordinating with HR, finance, and employees ensures transparency in calculations, deductions, and payments.

How to Become a Payroll Accountant

A career as a payroll accountant offers stability, growth, and the chance to become a key contributor to both financial and HR operations in a company. Becoming a payroll accountant requires a mix of education, skills, and practical experience. Many professionals are drawn to this role because it combines finance, compliance, and HR in one dynamic position.

Steps to Become a Payroll Accountant:

- Education: - A bachelor’s degree in accounting, finance, or business administration is usually required. - Courses in taxation, labor law, and HR management are highly valuable.

- Gain Relevant Experience: - Internships or entry-level roles in accounting or HR departments help you understand payroll processes. -Exposure to payroll software like Wafeq, ADP, or Gusto is an advantage.

- Develop Key Skills: - Attention to Detail: Payroll requires precise calculations. - Analytical Thinking: Understanding payroll trends, errors, and discrepancies. - Compliance Knowledge: Awareness of labor laws, tax regulations, and benefits management. - Technical Skills: Proficiency in Excel and payroll systems.

- Professional Certifications (Optional but Beneficial): - Certified Payroll Professional (CPP) - ACCA or CPA with payroll specialization.

- Continuous Learning: Payroll rules, tax regulations, and benefits laws change frequently. Staying up to date is critical for accuracy and compliance.

Read Also about: Accounts Receivable Accountant: Responsibilities and Impact on Cash Flow

A payroll accountant plays a crucial role in ensuring employees are paid accurately, businesses remain compliant, and financial records stay reliable. From calculating gross and net salaries to managing deductions, recording payroll entries, and using modern payroll software such as Wafeq, their expertise touches every aspect of payroll management.

Take the stress out of payroll.

Take the stress out of payroll.

Let Wafeq automate your payroll process and ensure every payment is accurate.

.png?alt=media)