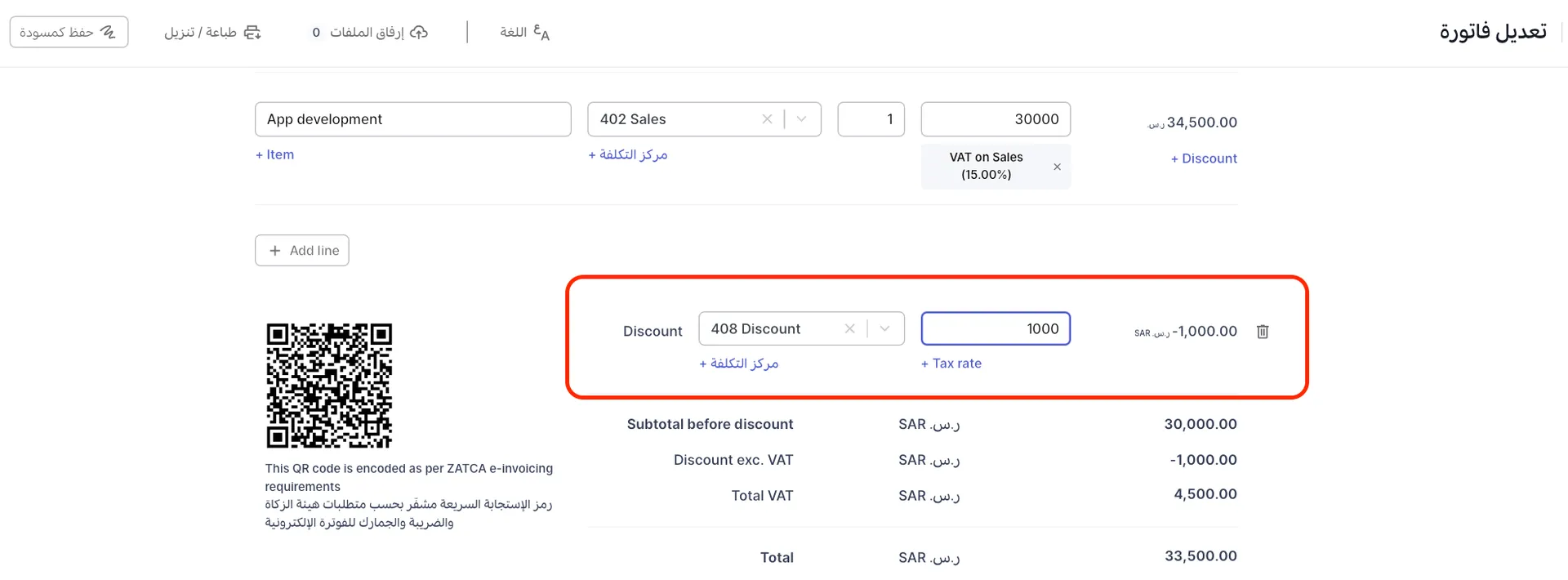

Adding a discount on an invoice total

Watch the video to learn how to add a fixed-amount discount to the invoice total amount.

Step-by-step instructions

To add a fixed amount discount on an invoice total:

1. When creating an invoice, click on the `+ Discount on total` near the invoice total.

2. In the `Select Account` dropdown, choose the account you'd like this discount to be booked against. For example, choose the `408 Discount` account if you'd like the discount to be shown against this account on the Profit and Loss statement.

3. Enter the discount amount

4. If the discount is subject to VAT, click the `Options` link to open additional options, then choose the tax rate that should be applied to the discount. You can also choose the `Cost center` that you'd like the discount to be booked against.

5. Save the invoice.

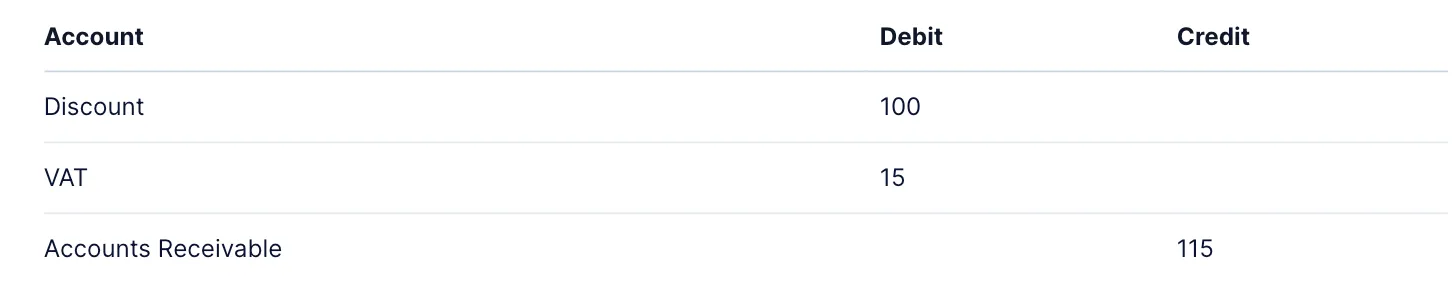

Journal entries generated by the discount

A discount of 100, subject to 15% VAT (i.e., 115 VAT inclusive,) will generate the following journal entries:

Discounts on quotes

Discounts on quotes

You can also add fixed-amount discounts on quotes. When you convert a quote to an invoice, the discount will be copied over.

![New Product Features [March-2023]](https://firebasestorage.googleapis.com/v0/b/wafeq-docs.appspot.com/o/medias%2Fd68397dc_Help Center - EN Article Cover-22.png?alt=media)

.png?alt=media)